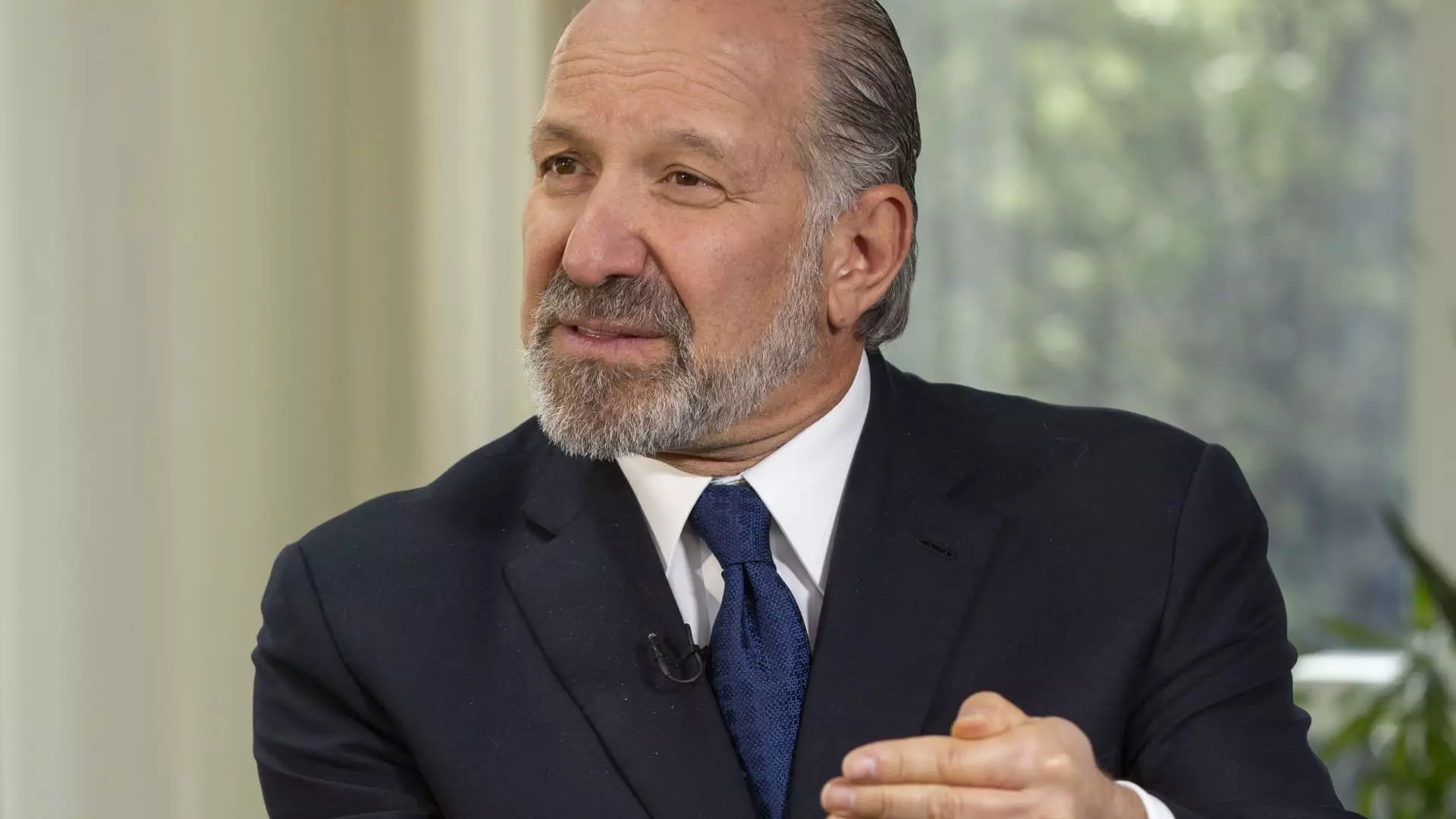

The recent statements by Howard Lutnick, the U.S. Commerce Secretary, about August 1st serving as a hard deadline for tariff payments expose a troubling narrative about American economic dominance. While the administration promotes these tariffs as a strategic move to strengthen bargaining power, the underlying message reveals an alarming tendency to wield economic measures as blunt instruments of coercion. By framing tariffs as a “hard deadline,” the U.S. sends a destabilizing signal to global partners, implying that economic diplomacy is secondary to unilateral pressure. This approach not only risks igniting trade wars but also undermines the collaborative principles necessary for a resilient international economy.

Furthermore, Lutnick’s assertion that countries can still negotiate after August 1st indicates a superficial commitment to dialogue, masking an underlying rigidity that favors coercion over cooperation. Such tactics are shortsighted, likely to provoke retaliatory measures, and damaging to the multilateral trade system. These actions threaten to precipitate a cycle of retaliation, pushing the world closer to economic fragmentation rather than fostering mutually beneficial agreements.

The Fallacy of Fair Tariff Enforcement

Lutnick’s mention of specific baseline tariffs, especially targeting small nations such as those in Latin America, the Caribbean, and Africa, is indicative of an asymmetrical approach defined more by power plays than fairness. Imposing a 10% or higher tariff baseline on vulnerable economies disregards their developmental challenges and the potential for these measures to deepen inequalities. Such tariffs may be presented as “fair,” but in reality, they serve as economic leverage used to extract concessions from weaker nations under the guise of national security or economic fairness.

The suggestion that bigger economies will either “open themselves up” or pay “a fair tariff” hints at a binary choice that neglects the complexities of global trade. It’s a reductive view that simplifies nations’ economic realities into coercive decisions, often ignores their sovereignty, and dismisses the importance of mutually respectful negotiations. Instead of fostering fair trade relationships, these tariffs risk breeding resentment and economic instability, especially among nations already struggling to develop.

The Danger of Economic Imperialism

President Trump’s recent move to send tariff letters, announcing rates as high as 40%, reveals a pattern of economic imperialism cloaked in nationalism. While protecting domestic industries is understandable, the aggressive enforcement of tariffs through unilateral deadlines places unnecessary strain on international relationships. Such policies threaten to turn global trade into a battleground rather than a mechanism for shared prosperity. They suggest a zero-sum game, where American interests eclipse collective progress.

This approach reflects an alarming confidence that America can set the terms unilaterally, disregarding the mutual interests that underpin international cooperation. In the longer term, this not only risks retaliation but also diminishes America’s moral authority to lead global economic conversations. Instead, a more balanced strategy rooted in fairness, dialogue, and respect for sovereignty would better serve both American interests and the stability of the global economy.

The aggressive posture encapsulated in Lutnick’s statements and Trump’s tariffs exemplifies a shortsighted nationalism that, if unchecked, could undermine decades of economic progress and global stability. It’s time for American policies to shift away from coercion and toward constructive engagement—recognizing that true strength lies in collaboration, not dominance.

Leave a Reply