In the ever-evolving landscape of the stock market, certain companies consistently stand out as beacons of innovation and resilience. The recent endorsement by Bank of America of key players such as Nvidia, Amazon, Netflix, and Boot Barn reflects a broader sentiment of optimism amidst uncertainty. These organizations are not merely weathering the storm; they are actively capitalizing on emerging trends and consumer demands, positioning themselves for sustained growth. This analysis delves deeper into why these companies are not just surviving but thriving, illustrating a compelling argument for investors seeking robust opportunities.

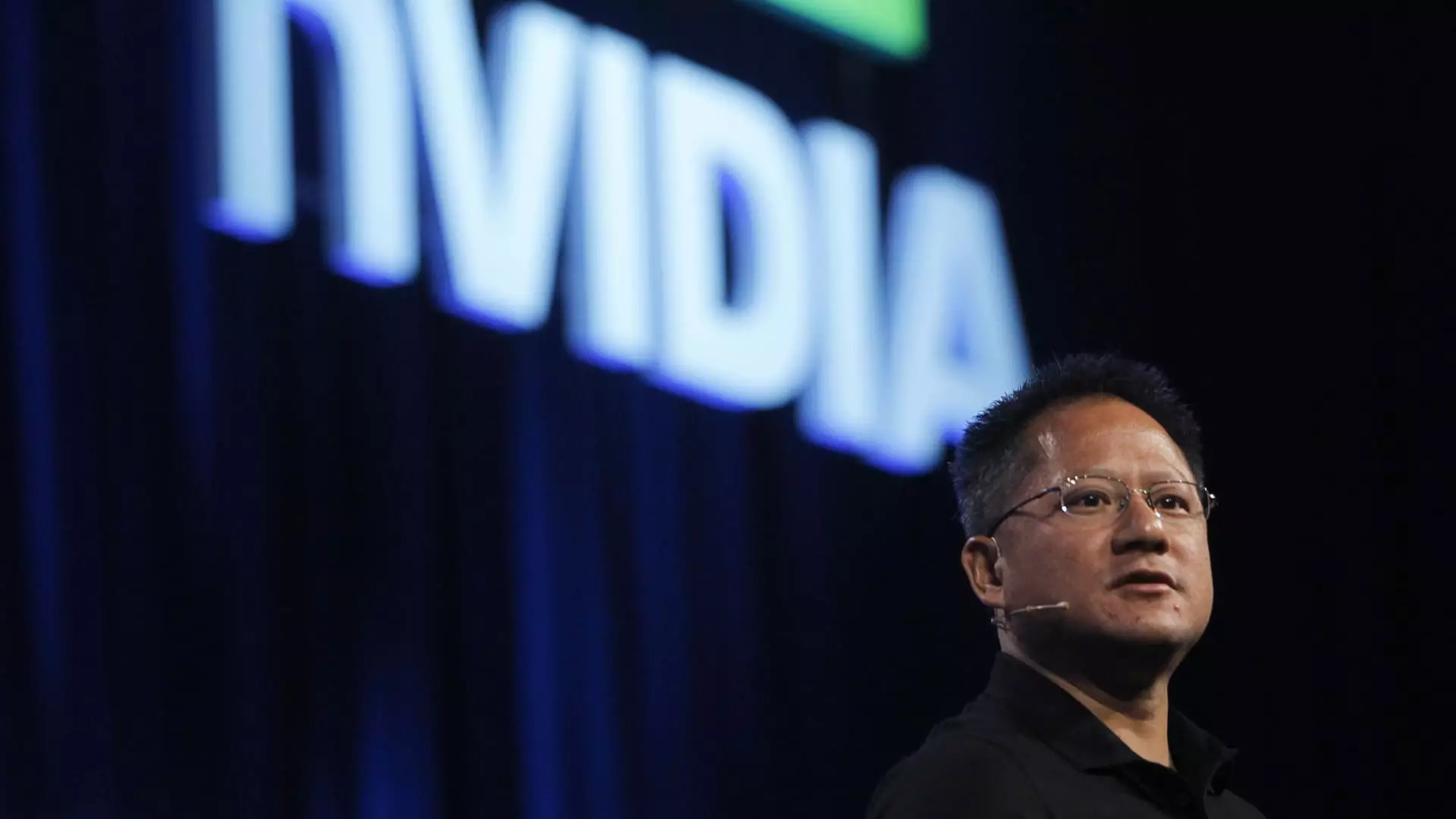

Nvidia: The AI Vanguard

Nvidia has transcended its identity as a graphics processing unit (GPU) manufacturer; it now stands at the forefront of artificial intelligence and machine learning. Analysts have championed Nvidia’s ability to leverage its technology to dominate a sector that is poised for exponential growth. The company’s anticipated price target of $180 reflects a deep-rooted confidence in its continued dominance. Consumers and industries alike are increasingly integrating AI into their operations, and Nvidia is uniquely positioned to benefit from this relentless trend.

Critically, the stock isn’t just about the technology itself; it’s about the vision. Nvidia has established a formidable ecosystem—one characterized by developer support, scalability, and innovative use cases that extend beyond traditional gaming circuits into realms like autonomous vehicles and virtual reality. This broad applicability of their technology strengthens their market position, making them a treasured asset in any investment portfolio.

Amazon: The E-Commerce Titan

When discussing market giants, one cannot overlook Amazon, an entity that has redefined the e-commerce landscape. Recently, analysts raised their price target to symbolize their confidence in Amazon’s unique growth trajectory fueled by automation and robotics. The introduction of advanced technologies, such as drones and AI-driven warehouse management systems, is not merely a logistics improvement; it promises significant cost reductions and enhanced Market competitiveness.

While some may perceive Amazon’s approach as a threat to traditional retail, it is essential to acknowledge the nuanced narrative. Amazon’s commitment to innovation drives better prices and selection for consumers. Moreover, its strategic diversifications into cloud computing and advertising only solidify its position in an increasingly digital world. The notion that Amazon’s growth is only tethered to product sales is an outdated perspective; its ability to adapt and exploit multiple revenue streams ensures its relevance in the marketplace.

Netflix: Streaming Success Story

Netflix, often heralded as the pioneer of streaming services, remains a critical player in the media landscape. Analysts recently adjusted their price target significantly upward, driven by robust subscriber growth and innovative content strategies. The fact that Netflix continues to adapt and roll out new advertising technologies illustrates its proactive approach to market demands.

However, one must critique the inherent risks associated with such bold projections. While Netflix enjoys a first-mover advantage, the competitive landscape is increasingly crowded, with various platforms vying for viewer attention. Moreover, its commitment to producing high-quality content comes at a price—one that could impact margins if subscriber growth slows. Nevertheless, Netflix’s unmatched global reach and powerful brand resonate deeply with consumers, ensuring it remains relevant in an age where content is king.

Boot Barn: Western Wear Reinvented

Boot Barn is a veritable underdog in this list of heavyweights, yet its growth narrative deserves equal attention. This Western-themed retailer has not only carved out a niche marketplace but has been strategic about expanding its influence. With a recent price target adjustment reflecting a positive trend across various merchandise categories, it is evident that Boot Barn appeals to a diverse consumer base.

While consumers may regard Boot Barn as a seasonal novelty, a closer examination reveals a commitment to quality and selection that transcends trends. The company’s focus on enhancing customer experience—through exclusive product lines and superior service—positions it as more than just a retailer. It’s a community staple embracing an enduring culture, blending nostalgia with modern retail strategies. This dual focus on tradition and innovation bodes well for its future.

Cautionary Notes and the Importance of Vigilance

Despite the positive outlook for these companies, it’s crucial for investors to remain vigilant. The stock market is notoriously unpredictable, and even the giants can face headwinds from macroeconomic fluctuations or changing consumer preferences. Investors must balance optimism with a critical lens, continuously assessing not only the potential for growth but also the risks involved.

The amplified focus on technology and adaptability by these companies signifies a pivotal shift in how we perceive traditional industries. By embracing innovation and preparing for future demands, they illustrate what it means to thrive in a modern economy. While it is an exhilarating time to consider investments in such forward-thinking companies, it is also a reminder that with great opportunity comes the need for rigorous analysis and a thorough understanding of the market dynamics at play.

Leave a Reply