In a world where digital currencies have gained immense traction, the implications of cybercrime within this sphere cannot be overstated. The recent sentencing of Ilya Lichtenstein has highlighted significant aspects surrounding Bitcoin theft, laundering activities, and the burgeoning legal framework surrounding cryptocurrency crimes. Not only did Lichtenstein’s actions shake the cryptocurrency community in 2016, but they also raised alarms about the vulnerabilities present in digital finance—and the ongoing challenges in curbing illicit activities within this decentralized landscape.

In August 2016, a monumental hack targeting the cryptocurrency exchange Bitfinex led to the unauthorized extraction of nearly 120,000 Bitcoin—a staggering figure at that time, equating to about $70 million. The orchestrator, Ilya Lichtenstein, carried out a systematic plan that involved executing over 2,000 unauthorized transactions. Such a breach opened a floodgate of discussions regarding digital security and the efficacy of legal measures aimed at protecting virtual currency. Lichtenstein utilized advanced techniques that baffled many, making it one of the most significant thefts in the cryptocurrency’s history. The ruse, however, did not end with the heist; it paved the way for an elaborate money laundering scheme aimed at concealing his ill-gotten gains.

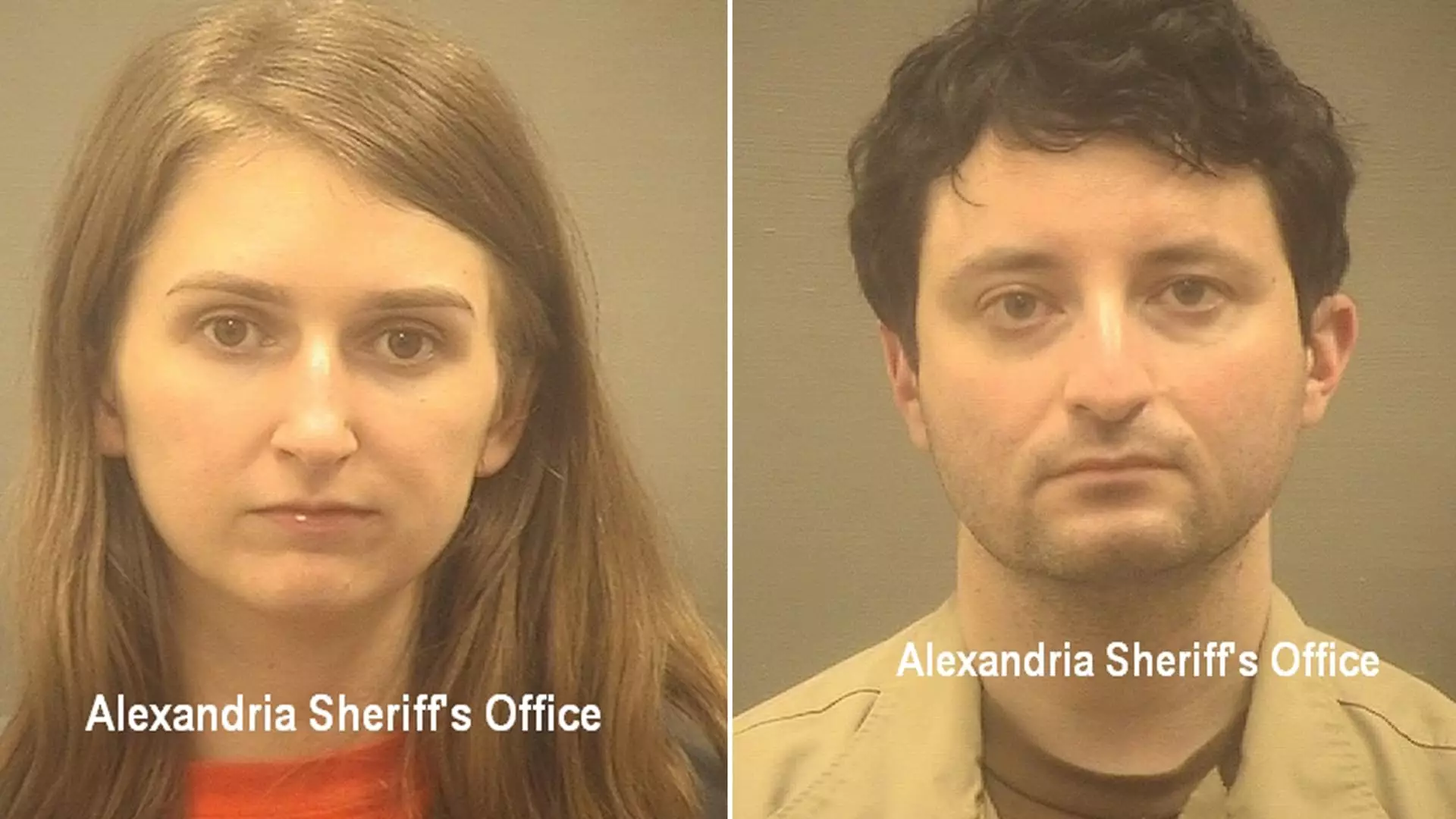

After more than 18 months of investigation and legal wrangling, Lichtenstein was sentenced to five years of imprisonment for his role in the money laundering conspiracy, alongside his wife, Heather Rhiannon Morgan. This outcome is pivotal in setting a precedent in the cryptocurrency sphere, where the legal repercussions often appear murky. While the potential maximum sentence reached 20 years, the judge, Colleen Kollar-Kotelly, opted for a comparatively lenient term. Lichtenstein’s admission of guilt during the plea hearing marked a significant turning point, as it not only confirmed his involvement in the notorious hack but also showcased a willingness to assume responsibility—which can often influence judicial outcomes.

Prosecutors painted Lichtenstein as a mastermind of some of the most convoluted laundering methods witnessed by federal authorities. The IRS described the techniques as intricate and sophisticated, revealing the lengths to which he went to obscure the trail of stolen funds. This raises a critical issue: as the cryptocurrency market matures, sophisticated fraud techniques evolve simultaneously. Organizations and regulatory bodies must continually adapt their strategies to combat technological ruses that facilitate crime.

Moreover, the case highlights the federal government’s capacity to trace stolen cryptocurrency, albeit a challenging endeavor. With advancements in blockchain forensics and investigative technologies, authorities are increasingly capable of uncovering and reclaiming stolen assets. At the time of the couple’s arrest in February 2022, the federal government had successfully seized over 94,000 Bitcoin, worth billions in today’s market, which suggests a promising trajectory in asset recovery processes.

As Lichtenstein’s case draws to a close, it raises urgent questions regarding the future of cryptocurrency regulation. The expansive rise in Bitcoin’s value from the time of the hack to the present—now valued at approximately $10.5 billion—casts a long shadow over regulatory frameworks worldwide. As more individuals are entangled in the cryptocurrency ecosystem, the necessity for stringent policy implementation becomes undeniable.

The anticipated restitution of seized assets to Bitfinex and other affected parties indicates a shift towards effective reparative measures in cryptocurrency fraud cases. It underscores the velocity at which authorities are now considering preemptive and punitive actions against cybercriminals.

The sentencing of Ilya Lichtenstein serves as a crucial milestone in the fight against cryptocurrency-related crime. Beyond illustrating the complexities of cyber heists and money laundering, this high-profile case sheds light on the legal vulnerabilities and regulatory challenges that still loom large over the digital currency landscape. As innovations continue to evolve, so too must the strategies employed by governments and law enforcement agencies to safeguard the integrity of the rapidly expanding cryptocurrency ecosystem. Lichtenstein’s story is not merely one of crime and punishment; it serves as a clarion call to rethink the safeguards and structures essential for a secure digital financial future.

Leave a Reply