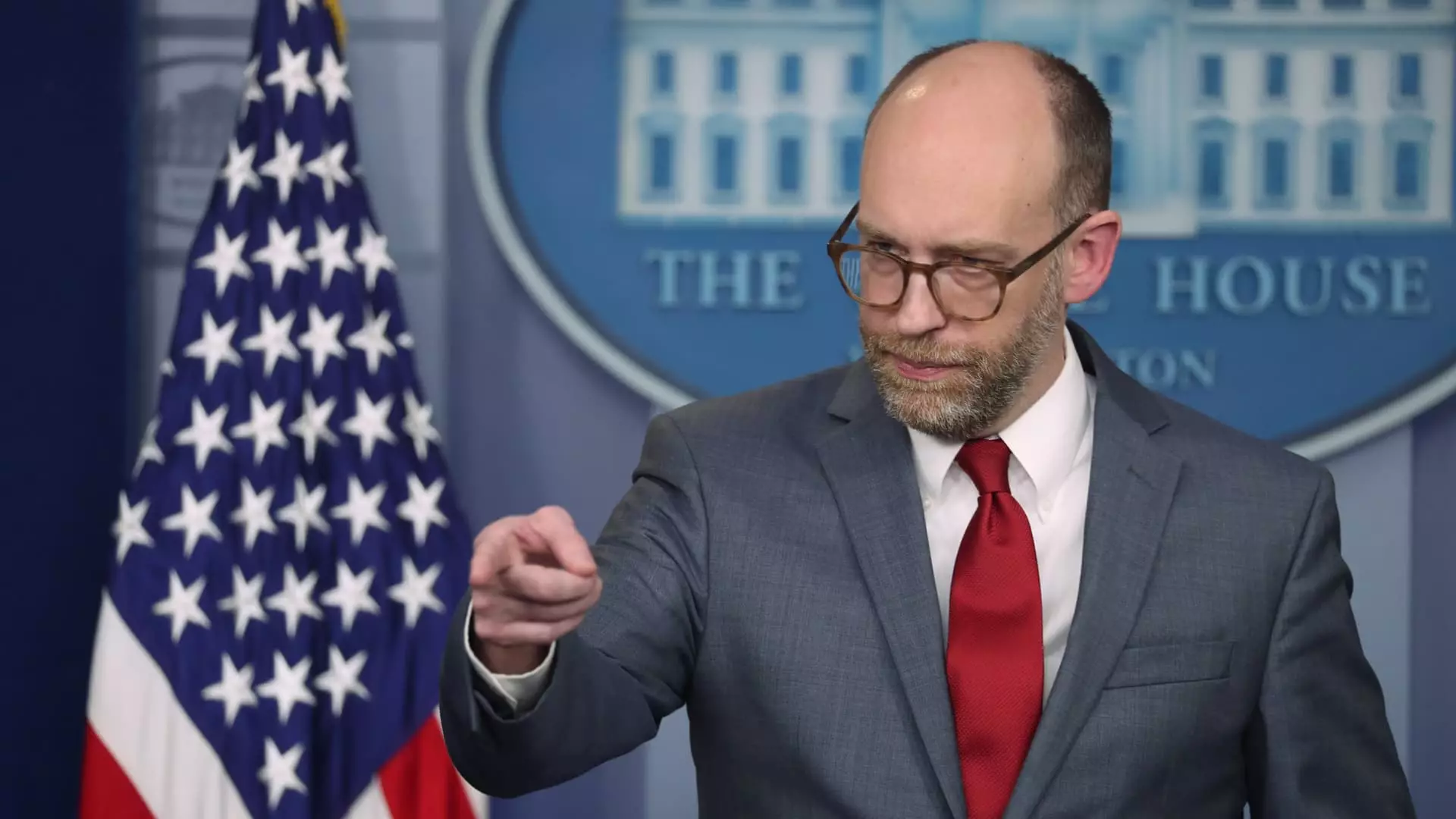

In an unexpected turn of events, the Consumer Financial Protection Bureau (CFPB) has been thrust into a state of limbo as employees were instructed to work remotely due to the temporary closure of its Washington, D.C. headquarters. This decision, relayed via a memo from Chief Operating Officer Adam Martinez, reflects broader implications for the agency’s operations and sustainability. The memo was prompted by an earlier directive from the newly appointed acting director Russell Vought, who has recommended a cessation of the majority of the agency’s supervisory functions, drawing concern among staff and stakeholders alike.

Vought’s recent actions signal a significant shift in the agency’s oversight capabilities. By effectively putting a hold on the supervision of financial firms, he has raised questions about the CFPB’s authority and future operations. This tight hold on the reins can be attributed to the overarching implications of the political landscape influencing regulatory bodies. Specifically, with an influx of influence from operatives associated with Elon Musk’s DOGE, whose presence at the CFPB has been reported, the agency faces challenges in maintaining its integrity and operational standards.

Musk himself has openly criticized the CFPB, suggesting drastic changes by sharing sentiments on public forums, including the ominous statement “CFPB RIP” on X (formerly known as Twitter). His comments reflect broader anti-regulatory sentiments and could potentially influence agency scrutiny from a political standpoint. The infusion of DOGE operatives, who reportedly have been given access to sensitive agency data, raises alarms about the overall security and ethical standards within the agency, signaling significant legislative and ethical crossroads.

Vought’s directive to halt funding for the CFPB indicates a drastic attempt to redesign how federal agencies operate. He described this decision as a necessary step towards reducing “unaccountability” within the CFPB, suggesting a push towards a more stringent management style that may or may not benefit consumer advocacy efforts. The implications of freezing funding could hinder not only the immediate functions of the CFPB but may also have larger ramifications for consumer protections across the financial landscape.

Moreover, the recent turmoil raises significant debates on the role of regulatory agencies. An agency that was originally created to safeguard consumer interests and ensure accountability in financial practices seems to be facing the threat of existential challenges spurred by ideological beliefs that argue against its foundational purpose. As the CFPB grapples with these shifts in governance and resets its operational framework, the economy’s most vulnerable populations might feel the effects of disarray within this critical regulatory body.

Looking Ahead: What Does the Future Hold?

As the situation continues to evolve, stakeholders, advocates, and consumers alike are left wondering about the future of the CFPB and the broader implications for financial consumer protections across the nation. The challenges faced by the CFPB serve as a reminder of the complex interplay between political influence, governmental oversight, and the practical needs of consumers in an ever-changing financial landscape. How this agency will navigate its present crisis and adapt to external pressures remains to be seen, but the urgency for clarity and direction is paramount.

Leave a Reply