The state of the U.S. economy in 2023 has been a topic of concern and speculation among Americans. However, despite various challenges and uncertainties, the macroenvironment ended up performing quite well. This article delves into the key aspects of the economy in 2023, highlighting its resilience, consumer spending, job market, inflation, stock market growth, and potential future developments.

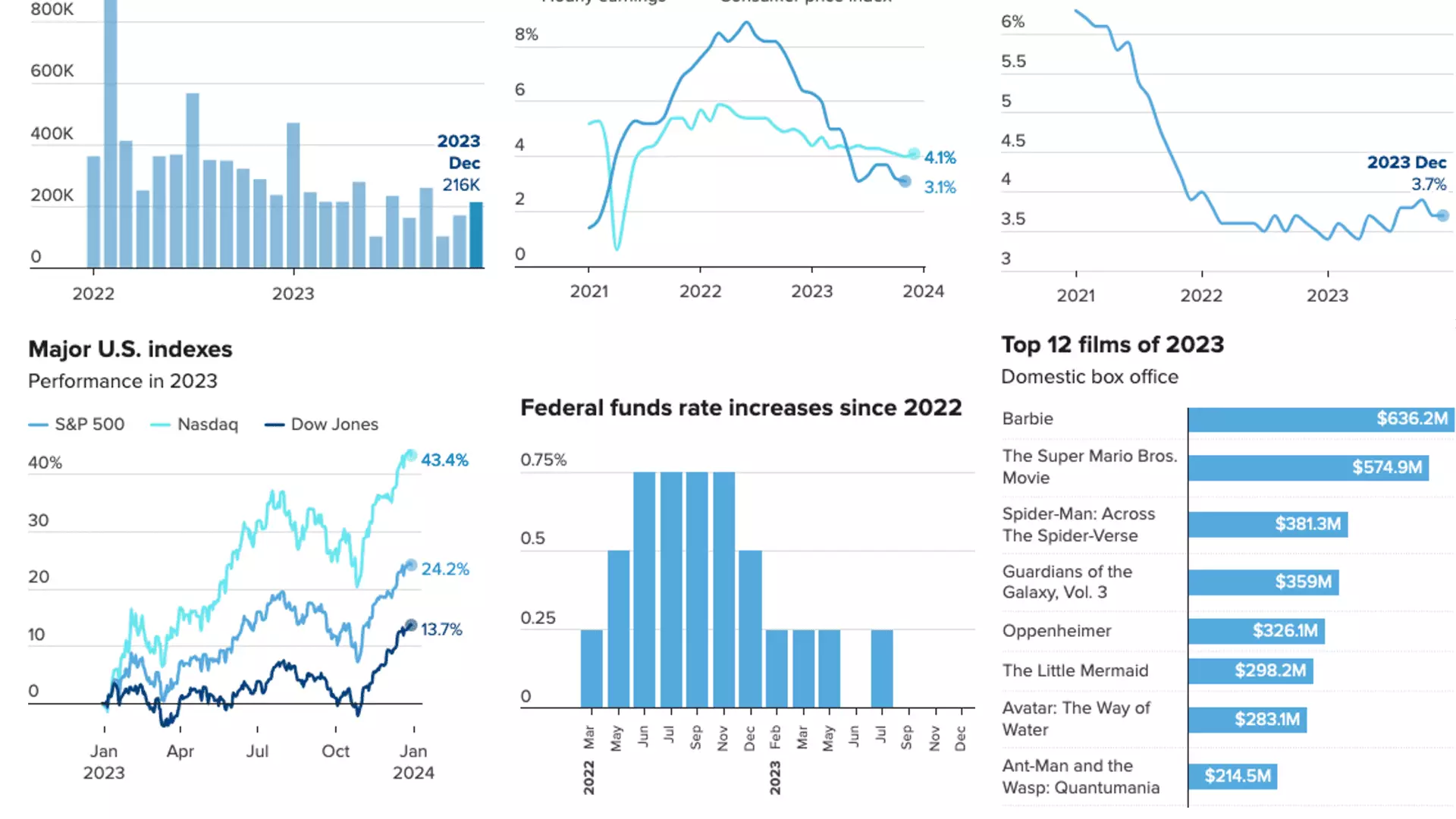

One of the remarkable aspects of the U.S. economy in 2023 was its strong job market. According to data released by the U.S. Bureau of Labor Statistics, over 200,000 jobs were created in December alone. Although previous estimates for job creation in October and November were revised downward, the unemployment rate remained low at 3.7%. December marked the 36th consecutive month of job creation, with nearly 2.7 million jobs created in total for the year.

Another noteworthy aspect was the resilience of consumer spending. Despite concerns that the Federal Reserve’s efforts to combat inflation might cool the labor market and dampen consumer spending, this was not the case. Consumer spending remained robust throughout the year, with monthly retail sales exceeding $600 million. This demonstrates that U.S. consumers were not deterred by economic headwinds.

Inflation was a significant concern for U.S. consumers in 2023. However, the rate of inflation cooled significantly throughout the year, bringing some relief. Additionally, wages steadily rose and eventually outpaced price increases. This upward trend in wages offered some optimism for workers and contributed to their increased purchasing power.

2023 marked the year of the travel rebound for Americans. The Thanksgiving holiday period witnessed a record-breaking number of passengers screened by the Transportation Security Administration at U.S. airports. This resurgence in travel indicated a renewed confidence in the economy and a desire to explore and experience new things.

Entertainment expenditure also saw a significant boost in 2023. The U.S. box office experienced a comeback with major hits such as “Barbie,” “Oppenheimer,” and Taylor Swift’s The Eras Tour concert film. These successes demonstrated the resilience and willingness of consumers to spend on entertainment, despite the challenges brought on by the Covid-19 pandemic.

The stock market demonstrated considerable growth in 2023, with all three major indexes showing substantial gains. Tech stocks led the way, contributing to some of the best growth for the Dow Jones Industrial Average, the Nasdaq Composite, and the S&P 500 in recent years. This positive performance in the stock market reflected investor confidence and a favorable business environment.

In addition to the stock market, cryptocurrencies also experienced a rebound in 2023. After hitting a low point in November of the previous year, Bitcoin prices ended 2023 at almost three times that previous low. This revival in crypto assets highlighted their potential and continued interest from investors.

The Federal Reserve’s Approach and Future Outlook

The Federal Reserve played a crucial role in shaping the state of the U.S. economy in 2023. After implementing historic rate increases in 2022, the Federal Reserve adopted a more tempered approach in 2023. Interest rates were raised at only four out of eight meetings, indicating a shift in focus from aggressive monetary tightening to a more balanced approach.

Chair Jerome Powell’s comments provided further insight into the future outlook. There is growing optimism among Fed watchers that rate cuts may be on the horizon in 2024. This potential reduction in interest rates could stimulate economic growth and address concerns about the impact of tightening monetary policy on various sectors.

While the overall performance of the economy in 2023 showcased resilience and growth, there were some trouble areas, particularly in the housing market. Mortgage rates remained high, with the average 30-year fixed rate nearly triple the end-of-2020 level. Although rates decreased significantly by the year’s end, existing home sales remained low according to data from the National Association of Realtors. These challenges are expected to persist until there is a substantial increase in housing inventory.

Despite concerns and uncertainties, the U.S. economy in 2023 demonstrated resilience and growth. The job market remained strong, consumer spending remained robust, and inflation cooled throughout the year. The stock market and cryptocurrencies experienced significant growth, while the Federal Reserve adopted a more balanced approach. Although challenges persisted in the housing market, overall, the state of the U.S. economy in 2023 offered optimism for the future.

Leave a Reply