In a significant move reflecting the rising tide of artificial intelligence (AI) demand, global semiconductor stocks have seen notable increases recently, largely fueled by the impressive financial results from Foxconn, a leader in contract electronics manufacturing. Foxconn’s recent announcement of record-breaking fourth-quarter revenue, reaching 2.1 trillion New Taiwan dollars (approximately $63.9 billion), marks a pivotal moment that signals robust momentum within the semiconductor sector. With a 15% increase year-over-year, this remarkable achievement underscores the closing market week, elevating sentiments across various markets.

Foxconn: Pioneering Growth in AI Driven Revenue

Foxconn, officially known as Hon Hai Precision Industry, underscored its strength in sectors crucial for AI’s proliferation, particularly in cloud and networking products. As the supply chain partner for tech giants like Apple, Foxconn’s expansion in AI-related products, particularly servers designed for AI applications, is noteworthy. This growth can be directly attributed to the escalating need for advanced compute capabilities in data centers and cloud infrastructure, which are essential for powering AI models. Despite some declines in consumer electronics, such as iPhones, the company’s overall financial health seems resilient.

The implications of Foxconn’s success extend well beyond its corporate walls. The resulting uptick in semiconductor stocks across Asia, Europe, and the United States reveals a broader investor optimism regarding the sustainable growth potential of the AI market.

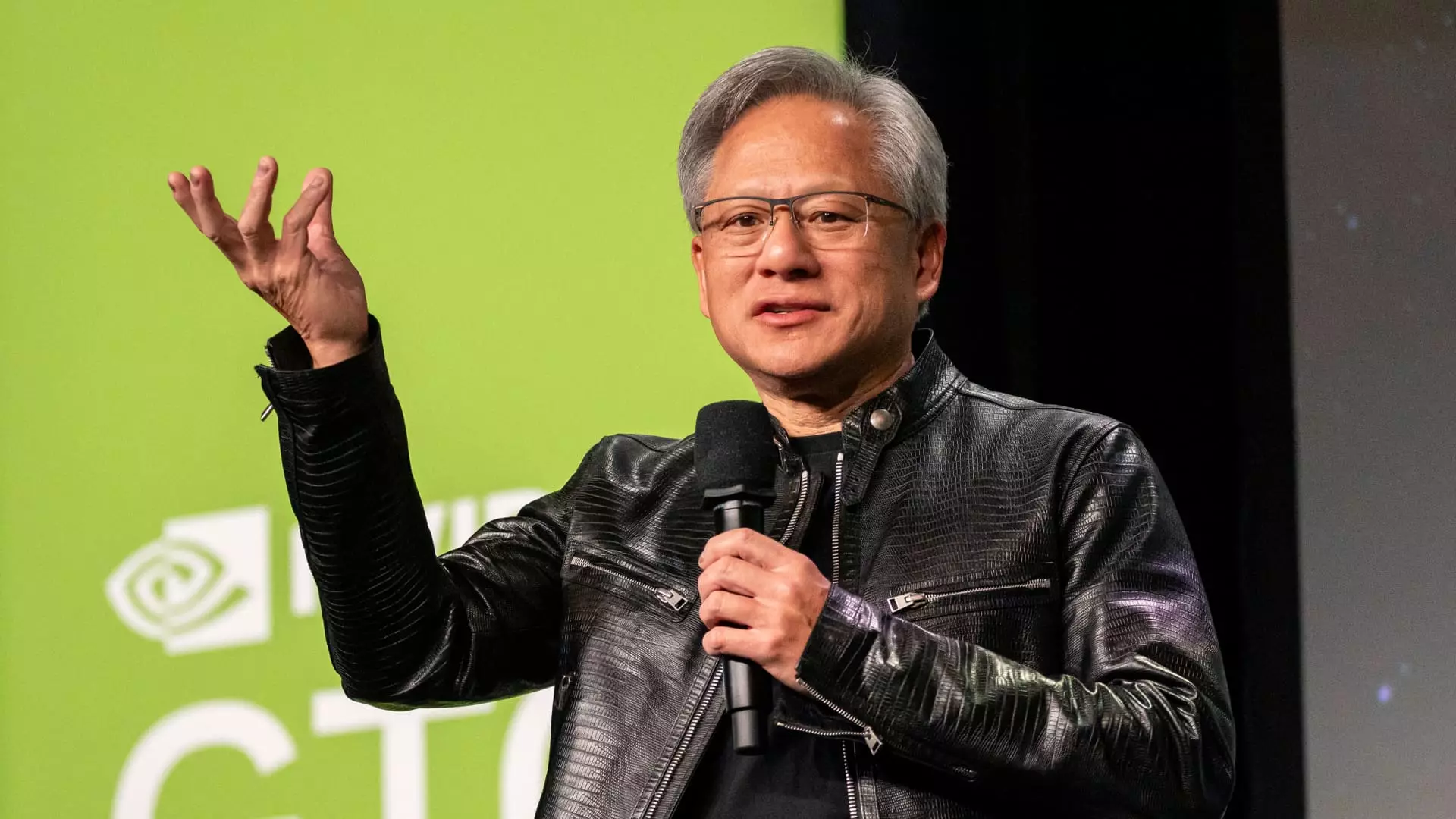

Following Foxconn’s announcement, shares of key semiconductor players, particularly those involved in GPU production, experienced a surge. Nvidia stands out, showcasing a 3% jump in stock value. The company’s CEO, Jensen Huang, is set to deliver a highly anticipated keynote at the upcoming 2025 Consumer Electronics Show, suggesting that Nvidia is keen on maintaining a pivotal role in the advancing AI landscape.

Furthermore, the financial landscape appears更加复杂 when considering Microsoft’s recent disclosure of plans to invest $80 billion in data centers specifically designed to handle AI workloads. This potentially monumental shift by Microsoft, alongside its peers’ heavy investments in GPUs, indicates that the tech industry’s appetite for AI capabilities is seemingly insatiable. The significant uptick in AMD and other chip producer stocks reinforces this narrative, with industry-wide optimism resonating through North American markets.

In Asia, Taiwan Semiconductor Manufacturing Company (TSMC) has emerged as a frontrunner, with its stock hitting record highs and climbing almost 5%. Regarded as the largest semiconductor manufacturer globally, TSMC plays a crucial role by producing chips for AMD and Nvidia—two power players in the AI chip design arena.

South Korean firms SK Hynix and Samsung also capitalized on this wave, recording gains of nearly 10% and 4%, respectively. The European market has not lagged either; significant increases were seen in shares of ASML, ASMI, and Infineon, reflecting widespread bullishness towards the semiconductor sector and a recognition of its integral role in the evolving technological ecosystem.

With the AI boom showing no signs of abating, the semiconductor industry is poised to navigate through uncharted waters. As demand surges for advanced chips that facilitate AI workloads, companies that establish themselves early in this transition are likely to dominate market shares. Not only is Foxconn setting benchmarks with its revenue, but the ripple effects of its performance on the semiconductor landscape illustrate a dynamic industry responding to technological imperatives.

Whether through enhancing chip capabilities, investing in next-generation manufacturing processes, or driving research and development efforts forward, the semiconductor sector is on the brink of significant evolution. As investors and industry stakeholders watch closely, monitoring upcoming announcements and technological advancements will be crucial to understanding where the next wave of growth will emerge. The interlinked relationship between AI and semiconductor growth embodies a robust landscape ripe with opportunity.

Leave a Reply