Nvidia, a company well-known in the gaming community for its graphics chips, has recently emerged as the most valuable public company in the world. With a market cap of $3.33 trillion, Nvidia has surpassed tech giants like Microsoft and Apple, thanks to its dominance in the realm of AI chips and data center operations.

Founded in 1991, Nvidia initially focused on selling chips for gamers to enhance their 3D gaming experience. Over the years, the company has diversified its offerings, delving into cryptocurrency mining chips, cloud gaming subscriptions, and most significantly, AI technology. This shift in focus towards AI has propelled Nvidia’s growth and solidified its position as a leader in the industry.

Nvidia currently holds about 80% of the market share for AI chips used in data centers. As companies like OpenAI, Microsoft, Alphabet, Amazon, and Meta increasingly rely on AI models and large workloads, the demand for Nvidia’s chips has soared. In fact, in the latest quarter, Nvidia’s data center business saw a remarkable 427% revenue increase from the previous year, accounting for a substantial portion of the company’s total sales.

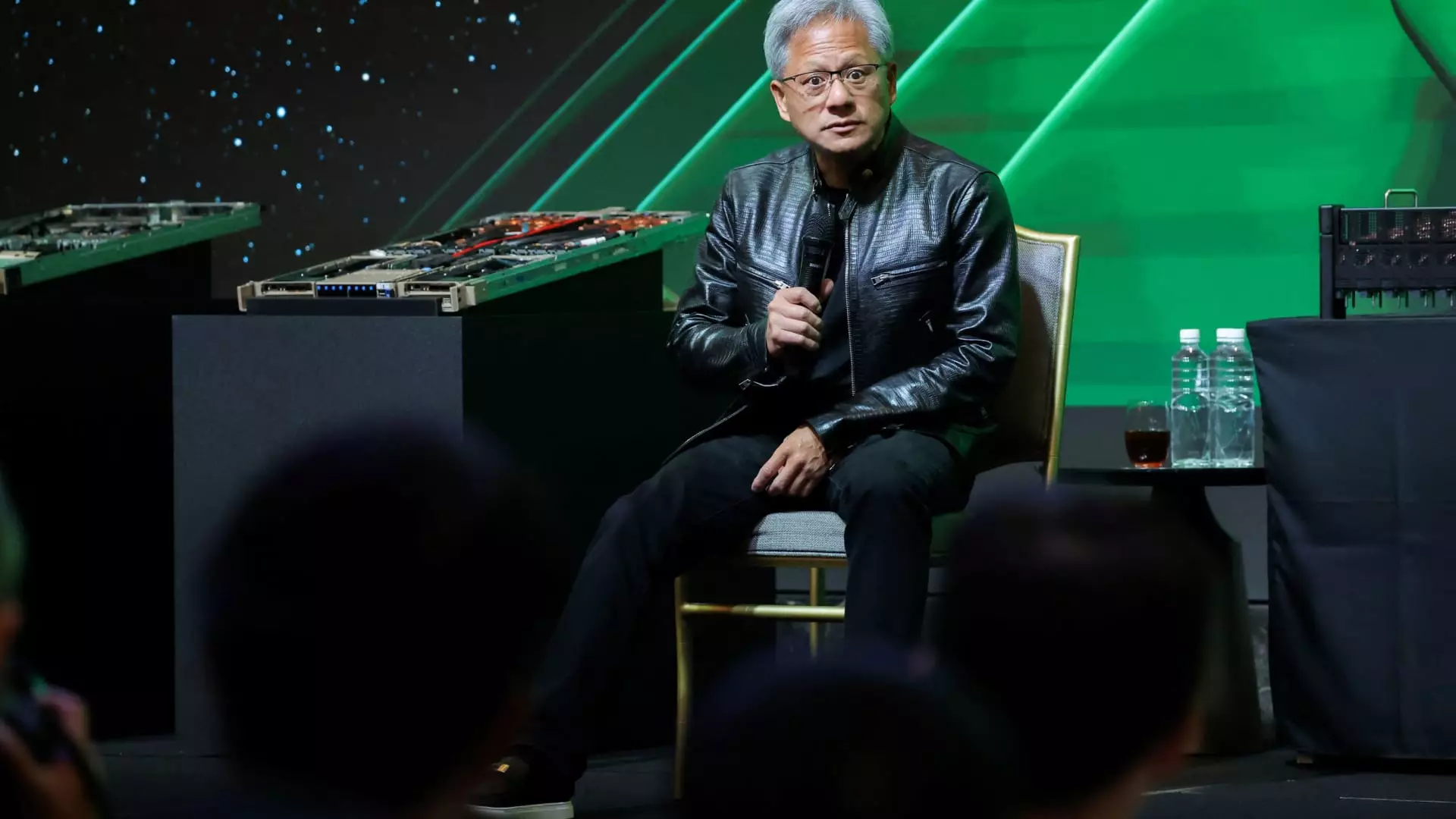

Nvidia’s stock has experienced a meteoric rise, with share prices climbing over 170% this year alone. The company’s market cap hit $3 trillion earlier this month, surpassing Apple and Microsoft. The exponential growth in Nvidia’s stock value has catapulted CEO Jensen Huang’s net worth to approximately $117 billion, solidifying his position as one of the wealthiest individuals globally.

While Nvidia’s rise has been phenomenal, it has also created ripples in the tech industry. Competitors like Apple and Microsoft, who have long been contenders for the title of the most valuable company, have seen their market values affected by Nvidia’s surge. Both companies have made significant strides in the AI space, with Microsoft integrating AI models into its key products and Apple investing in AI capabilities. However, Nvidia’s dominance in AI chips has positioned it as a key player in the market.

Nvidia’s recent stock split, in which the company implemented a 10-for-1 split, is aimed at further enhancing its position in the market. This move is expected to increase Nvidia’s chances of being added to the Dow Jones Industrial Average, a prestigious stock benchmark. As Nvidia continues to innovate and expand its AI capabilities, the company’s trajectory towards sustained growth and market dominance seems promising.

Nvidia’s transformation from a niche gaming chip provider to the most valuable public company in the world is a testament to its innovation and strategic vision. The company’s focus on AI technology, coupled with its dominance in data center operations, has propelled its meteoric rise in the tech industry. As Nvidia charts a path towards continued growth and expansion, it is poised to shape the future of AI and technology in the years to come.

Leave a Reply