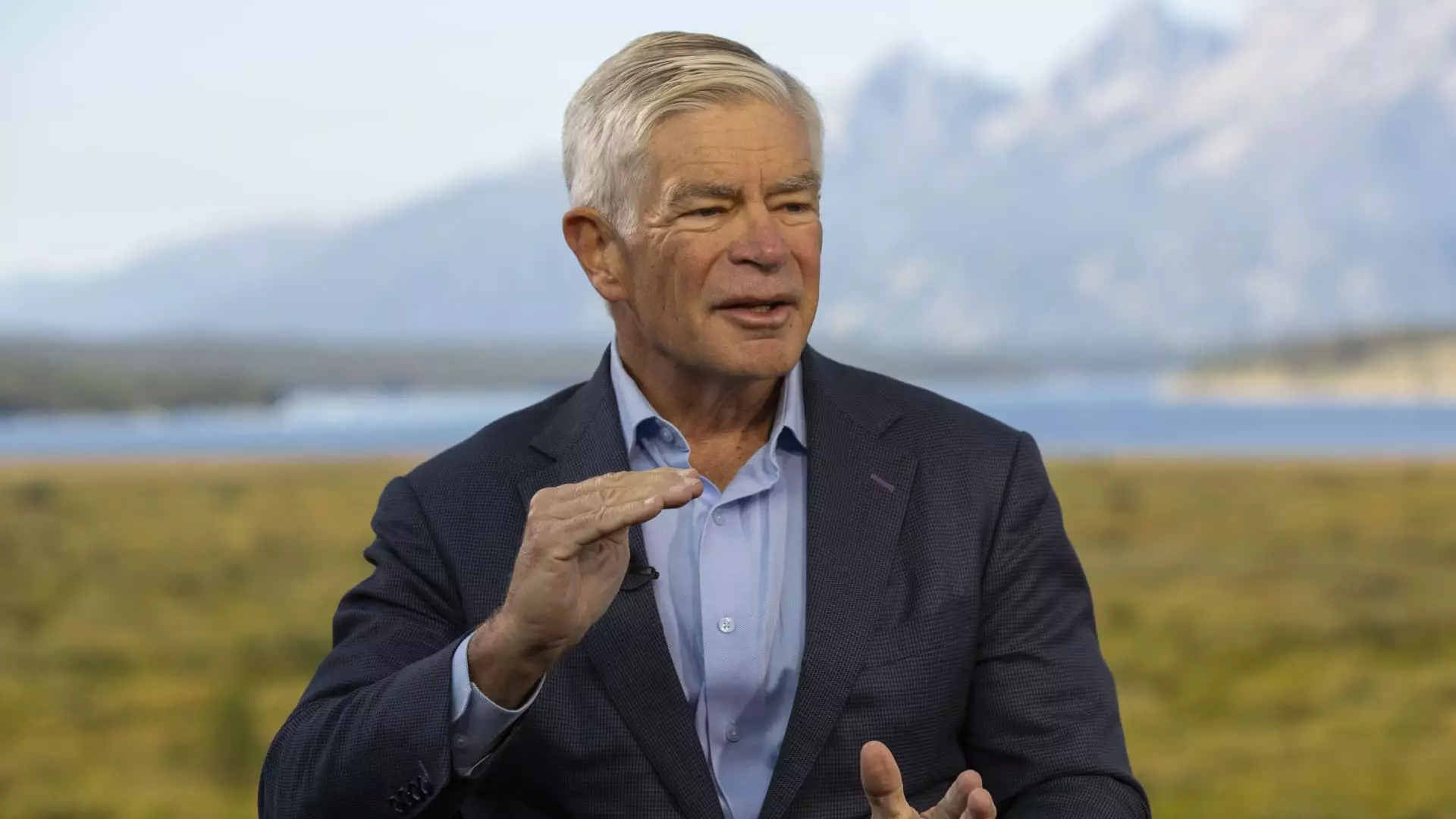

Philadelphia Federal Reserve President Patrick Harker recently expressed his support for an interest rate cut that is likely to happen in September. This announcement came during the Fed’s annual retreat in Jackson Hole, Wyoming, where Harker emphasized the need for a methodical easing of monetary policy to address concerns related to inflation and the labor market. With the markets already pricing in a high probability of a rate cut, Harker’s comments shed light on the deliberations taking place within the central bank.

Harker’s views on the upcoming rate decision indicate a cautious approach. While the markets anticipate a quarter percentage point reduction, there is still uncertainty about the magnitude of the cut. Harker pointed out that he is not firmly in favor of either a 25 or 50 basis point decrease and emphasized the importance of analyzing additional data before making a definitive judgment. This cautious stance reflects the complexity of the economic indicators that the Fed must navigate while making its decision.

The Federal Reserve has maintained its benchmark interest rate within a specific range for several years as it grapples with persistent inflationary pressures. The upcoming decision to lower rates is seen as a proactive measure to address potential weaknesses in the economy. Both the inflation trajectory and the state of the labor market are key factors influencing the Fed’s decision-making process. Harker’s emphasis on the non-political nature of the Fed’s decisions underscores the institution’s commitment to data-driven policy formulation.

In addition to Harker, Kansas City Fed President Jeffrey Schmid also provided insights into the future direction of monetary policy. Schmid highlighted the changing dynamics in the labor market, noting a shift from a tight labor market environment to a more moderate one. This transition has implications for inflation and wage growth, which are critical considerations for the Federal Reserve when setting interest rates. Schmid’s assessment of the current economic landscape suggests a need for continued monitoring and potential adjustments to monetary policy.

As the debate over an interest rate cut intensifies, the role of Federal Reserve officials in providing guidance and insights becomes increasingly important. Harker and Schmid’s comments offer a glimpse into the considerations and challenges facing the central bank as it navigates a complex economic environment. The upcoming rate decision in September will be closely watched by market participants and policymakers alike, as it will signal the Fed’s stance on addressing current economic conditions. The path to an interest rate cut is paved with uncertainties and trade-offs, requiring a nuanced approach to policy formulation.

Leave a Reply