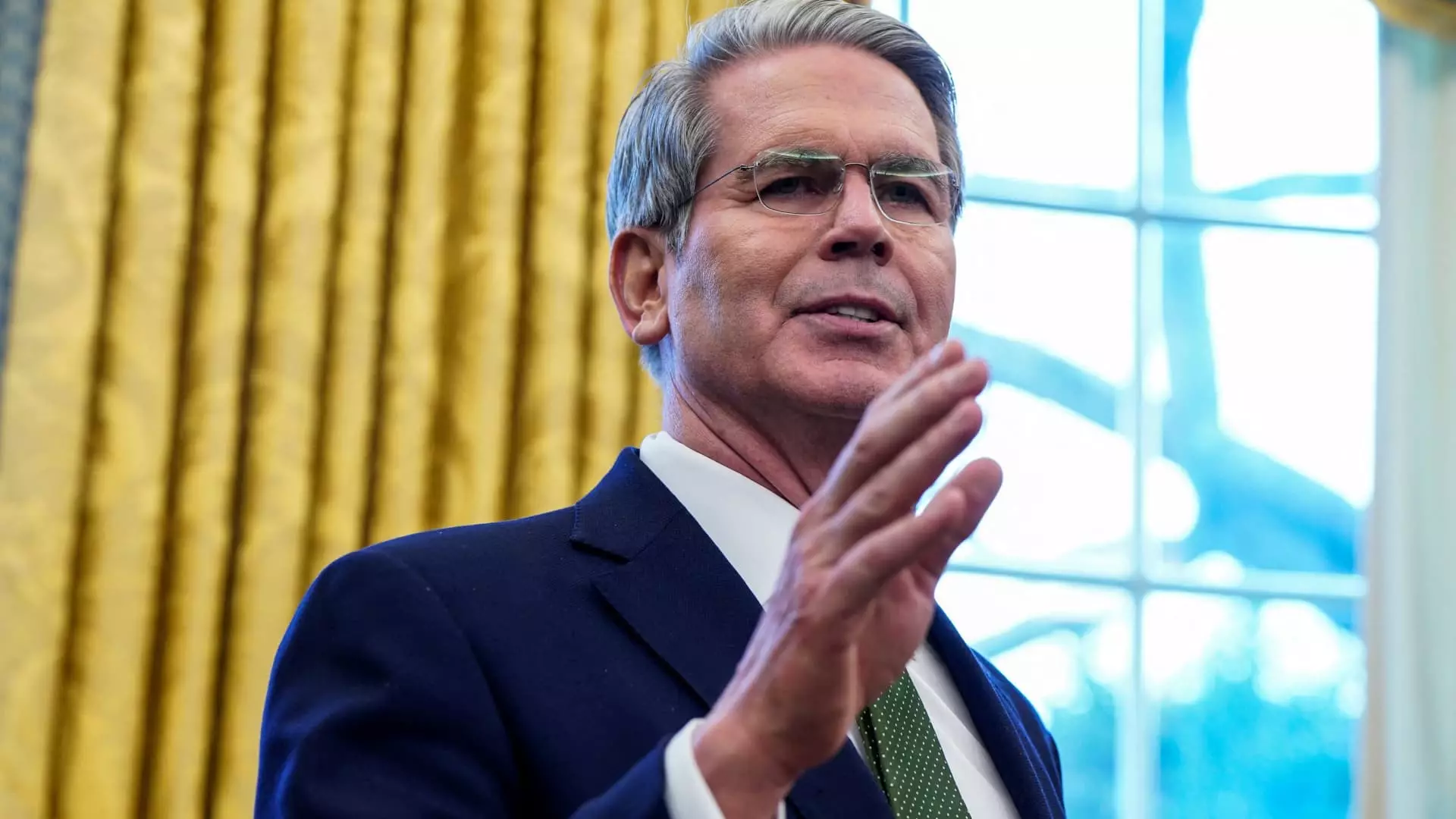

Under the Trump administration, a significant pivot has emerged concerning economic policy focus—specifically, a shift from reliance on the Federal Reserve’s monetary policy to a more aggressive application of fiscal policy to maintain low Treasury yields. This strategy emphasizes the importance of managing long-term interest rates, particularly the 10-year Treasury yield, over the traditional scrutiny of the federal funds rate set by the Federal Reserve. Treasury Secretary Scott Bessent has explicitly articulated this new approach, suggesting that it represents a fundamental change in the administration’s economic tactics aimed at spurring growth while navigating the complexities of market expectations.

The 10-year Treasury yield serves as a barometer for broader economic conditions, influencing not just federal borrowing costs but also consumer credit rates, mortgages, and overall market sentiment. Bessent’s comments underscore how the administration views long-term rates as pivotal to economic stability and growth. Historically, while rates set by the Federal Reserve have had a far-reaching impact across various sectors, the focus on the 10-year Treasury indicates a strategic departure from conventional reliance on central bank tools to stimulate economic activity. This reflects an evolving understanding of how market dynamics can influence governmental fiscal strategies.

Recent actions by the Federal Reserve have sparked debate among economists and policymakers. Beginning in September 2024, the Fed embarked on a cycle of rate cuts, reducing the federal funds rate by a full percentage point. This decision was intended to alleviate economic pressures but had the unintended consequence of increasing Treasury yields and inflation expectations, contrary to what many anticipated. Bessent’s remarks suggest that this disconnect is indicative of a more significant trend wherein the administration seeks to minimize Fed interference in favor of a self-sustaining economic model bolstered by efficiency and deregulation.

Tesla President Donald Trump, while markedly a critic of the Fed in his first presidential term, seems to have adopted a more hands-off approach regarding monetarist tools in the current administration. He posits that by fostering a conducive environment through tax cuts, energy deregulation, and spending reductions, market forces will naturally stabilize interest rates. This belief underscores a philosophy that prioritizes structural adjustments over monetary adjustments, suggesting that if the government can reduce its footprint and expenses, economic momentum will follow organically.

Among the administration’s foremost priorities is the goal of rendering the Tax Cuts and Jobs Act permanent. This legislation aims to reduce the overall tax burden on individuals and businesses, thus incentivizing investment and economic activity. Coupled with a renewed emphasis on energy exploration and a concerted effort to trim excess governmental expenditure, the administration seeks to create a fiscal environment that supports sustainable growth. The underlying message is clear: through strategic deregulation and robust tax strategies, the administration believes it can foster a healthy macroeconomic environment where interest rates naturally adjust without needing aggressive central bank actions.

Feedback from financial analysts like Krishna Guha of Evercore ISI highlights the delicate balance the administration must maintain. There’s a looming concern that if the 10-year Treasury yield breaches the critical 5% threshold, it could signify a downturn not only for Trumponomics but also for equity markets and real estate sectors sensitive to interest rate fluctuations. As of recent trading, the yield has positioned itself at approximately 4.45%, slightly receding from its January peak of 4.8%. This trend suggests that while the administration’s strategy may be bearing fruit in controlling yields, the market remains vigilant to any signs of instability.

As the Trump administration navigates the complexities of fiscal policy in an evolving economic landscape, its focus on Treasury yields over Federal Reserve actions marks a bold reassertion of control over economic factors. By transitioning from a reactive monetary stance to a proactive fiscal approach, the administration seeks to redefine the levers of growth amidst challenging conditions. The success of this strategy will depend on how effectively they can alleviate market anxieties while stabilizing long-term interest rates, thus steering the economy toward a sustainable trajectory.

Leave a Reply