In recent times, political betting markets have gained significant prominence, particularly as the 2024 U.S. presidential election approaches. These platforms provide an unfiltered glimpse into how the public perceives candidate viability, but they also raise critical questions regarding their authenticity and potential manipulation. With betting activities often reflecting a complex interplay of personal beliefs and financial incentives, the debate surrounding the integrity of these markets becomes more heated, especially when substantial amounts of money are involved.

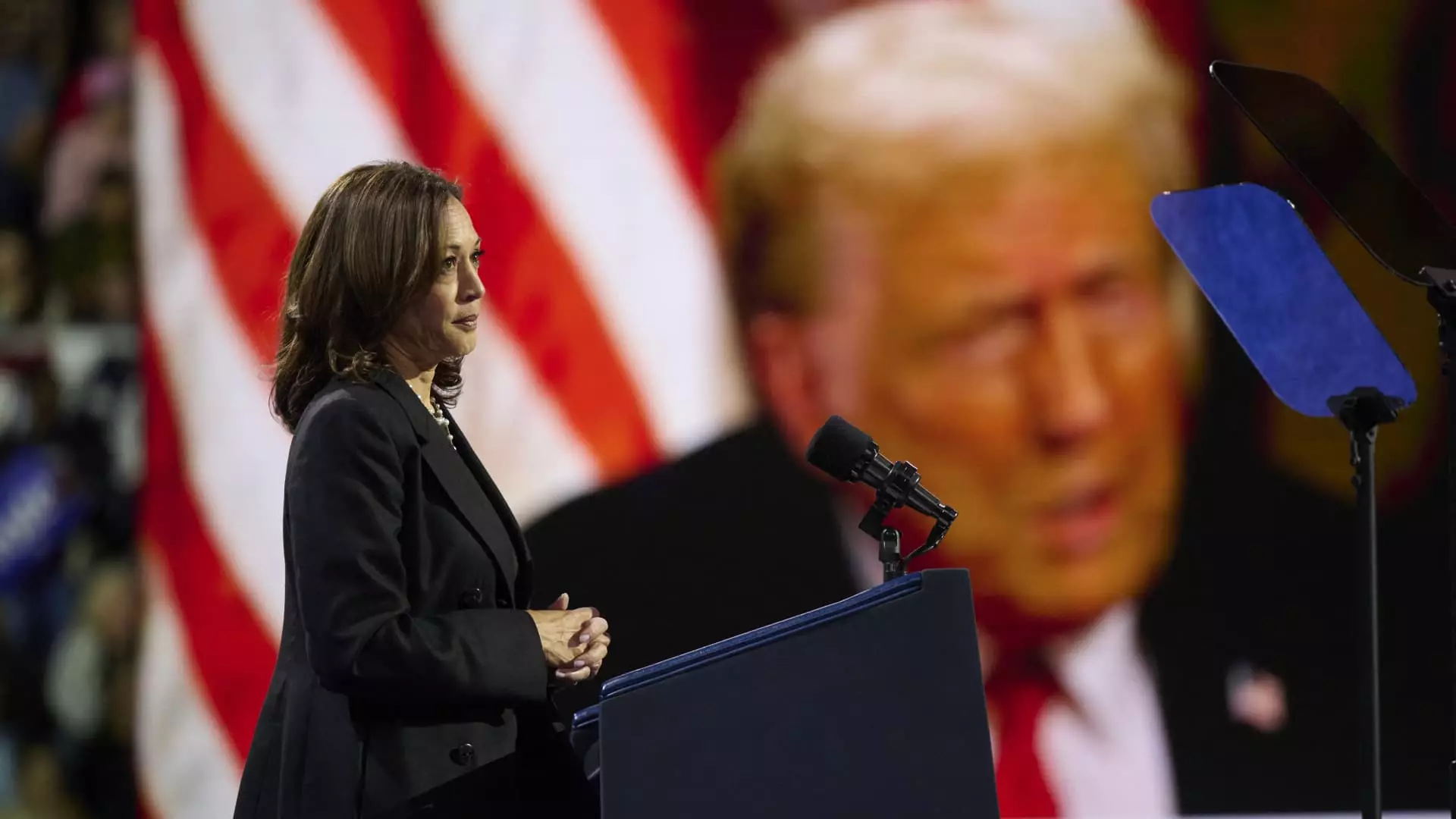

A striking incident involving the political betting platform Polymarket emerged this month when it was revealed that four accounts had collectively wagered over $28 million on the potential success of former President Donald Trump in the upcoming election. This substantial financial engagement has led to questions about whether a single entity is attempting to distort Trump’s electoral odds. Investigations confirmed that all four accounts belonged to a single trader, a French national described as having considerable financial expertise and a background in the trading sector.

The scrutiny intensified when it became known that these accounts were fueled by funds from a well-established cryptocurrency exchange, identified as Kraken. While Polymarket emphasized that there is no evidence to suggest that the trader is manipulating market odds, the lack of transparency in betting activities raises concerns. This single trader, now referred to as a “whale” in the market, could potentially skew perceptions of Trump’s support, misleading investors and voters alike.

As the political betting landscape changes, particularly in light of events surrounding Trump’s candidacy, perceptions formed through betting markets have begun to diverge significantly from conventional polling results. Advocates argue that these markets present a more “real-world” view of electoral outcomes because outcomes are directly tied to monetary stakes. High-profile advocates, like Tesla’s Elon Musk, have asserted that betting markets offer clearer insights into electoral prospects than traditional polling, as they reflect genuine investor confidence.

However, it is essential to recognize that prediction markets function differently than opinion polls. While polls gauge public sentiment about voting potential, betting markets measure the probability of specific events occurring, such as one candidate winning over another. Polymarket reiterated this distinction, emphasizing that the confusion between the two can lead to misleading interpretations regarding the candidates’ standings.

The legitimacy of political betting is further complicated by the regulatory landscape. Following a settlement with the Commodity Futures Trading Commission (CFTC) in 2022, Polymarket has prohibited U.S. traders from participating in betting activities. As a result, alternative platforms like Kalshi have emerged, offering predicted outcomes for the election while navigating their regulatory challenges.

Despite this, skepticism remains about whether these markets can accurately reflect public sentiment. As the CFTC continues to evaluate these platforms, the environment for political betting remains uncertain. It brings forth discussions about accountability, investor protection, and ethical implications tied to these high-stakes wagering activities.

As the countdown to the 2024 presidential election continues, the role of political betting markets is likely to become more critical, potentially impacting strategies for candidates, media narratives, and voter perceptions. The interests of traders wielding significant financial influence can shape the electoral narrative, questioning the integrity of outcomes and public understanding.

Looking ahead, it will be crucial to enhance the oversight of these markets to ensure they are credible and dependable. As stakes continue to rise, stakeholders—ranging from regulators to political analysts—will need to navigate the complexities associated with betting markets responsibly. While they could provide a unique lens through which to view electoral dynamics, it is essential to tread carefully, recognizing the implications of opinion manipulation and financial motivations at play in the arena of political betting.

The intersection of finance and politics in betting markets presents an intriguing yet tumultuous future landscape that merits ongoing exploration and scrutiny, reinforcing the need for transparency and robust regulation as these platforms evolve.

Leave a Reply