Nvidia shares skyrocketed above $1,000 for the first time in after-hours trading following the chipmaker’s release of its fiscal first-quarter results, exceeding analyst expectations. This surge reflects a growing enthusiasm among investors for Nvidia’s performance and innovation.

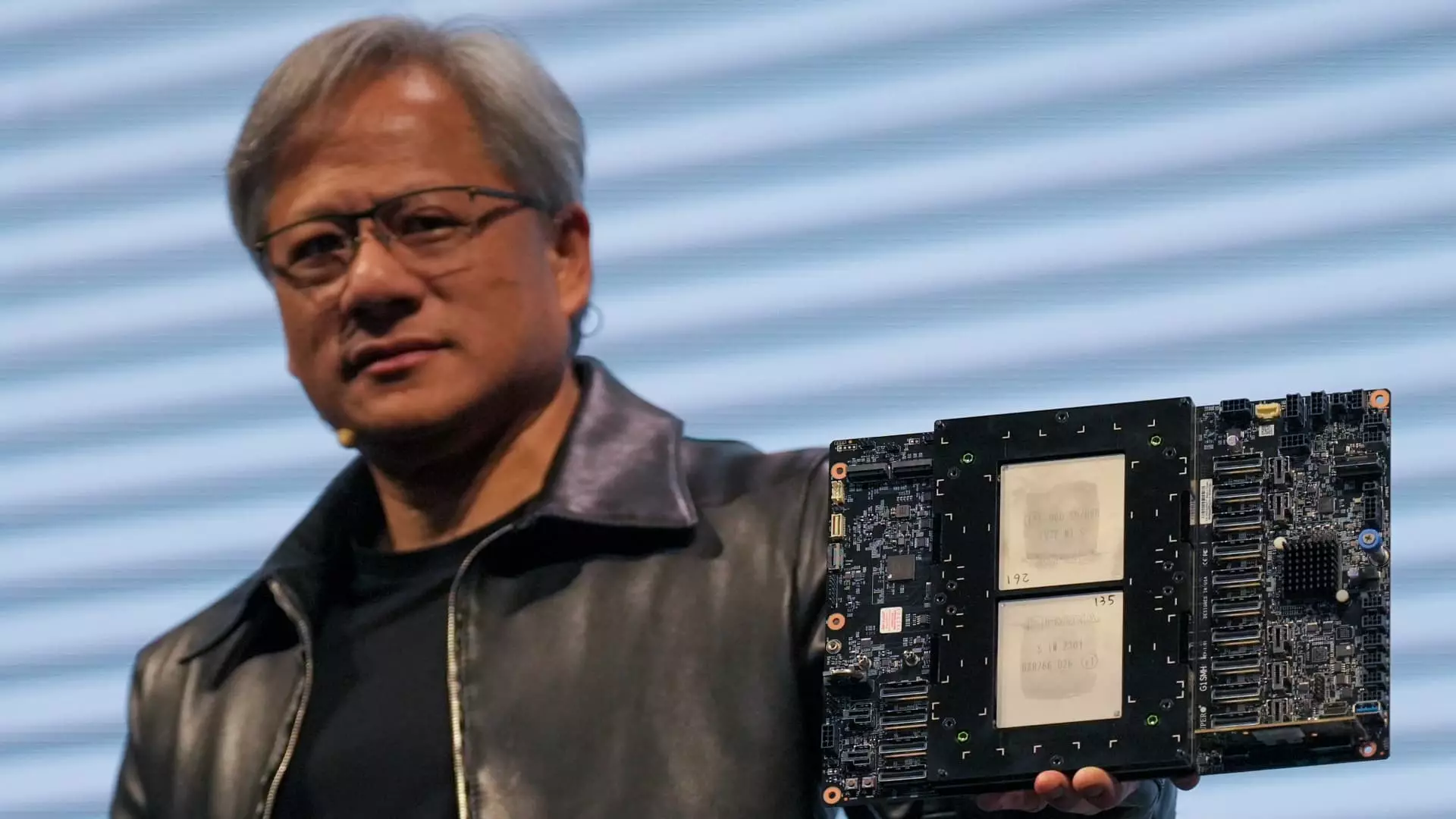

Nvidia’s quarterly earnings have increasingly become a litmus test for the AI market’s health, which has captured the attention of global markets in recent times. The company’s impressive results underscore the continuous demand for the AI-powered chips they manufacture, reaffirming their stronghold in the industry. CEO Jensen Huang’s announcement regarding the forthcoming revenue from Blackwell, their next-generation AI chip, has bolstered confidence in Nvidia’s future prospects.

Financial Outlook

Highlighted by an adjusted Earnings Per Share of $6.12 versus the expected $5.59 and a revenue of $26.04 billion as opposed to $24.65 billion, Nvidia’s financial performance has exceeded projections. Additionally, the company’s anticipation of $28 billion in sales for the upcoming quarter has instilled further optimism in investors.

Nvidia’s dominance in the data center market has proven to be a significant revenue driver, with the sector experiencing a remarkable 427% growth year-over-year to reach $22.6 billion in revenue. This exceptional performance can be attributed to the robust sales of their Hopper graphics processors, including the H100 GPU, substantiating Nvidia’s integral role in powering major AI servers for industry giants like Meta.

While Nvidia initially gained recognition for its contribution to the gaming industry, the company has significantly diversified its portfolio. Revenue from gaming, which increased by 18% to $2.65 billion, remains a vital aspect of their business. Furthermore, their involvement in automotive sales and professional visualization sales, though on a smaller scale compared to data centers, continues to contribute meaningfully to their overall revenue stream.

In addition to driving substantial business growth, Nvidia also prioritizes returning value to its shareholders. The repurchase of $7.7 billion worth of shares and payment of $98 million in dividends during the quarter exemplify their commitment to enhancing shareholder returns. The decision to raise the quarterly cash dividend from 4 cents per share to 10 cents, further underscores their dedication to shareholder value creation.

Overall, Nvidia’s exceptional quarterly performance, substantial revenue growth, and strategic planning for the future affirm its position as a market leader in the semiconductor industry. As they continue to innovate and expand their offerings across various sectors, Nvidia appears poised for sustained success and continued shareholder value creation in the foreseeable future.

Leave a Reply