In a recent turn of events, Nvidia has seen its market capitalization dip below the coveted $3 trillion mark, positioning Apple as the solitary member of this exclusive financial echelon. The downfall came sharply after the company’s quarterly earnings report, which revealed an over 8% drop in its share value, effectively erasing approximately $273 billion from its market cap. This decline highlights the volatility intrinsic to the tech sector and raises questions about Nvidia’s long-term sustainability amidst evolving market dynamics.

Despite being the second most valuable tech company in the United States, trailing behind Apple and sitting ahead of Microsoft, Nvidia’s 2025 trajectory has been concerning. The company has witnessed a deterioration of 10% in its stock valuation year-to-date, driven by investor apprehension regarding several factors, including impending export controls and tariffs, more advanced artificial intelligence models, and an overall slowdown in revenue growth. This situation exemplifies how rapidly changing economic, regulatory, and technological landscapes can impact even the strongest players in the tech arena.

Interestingly, Nvidia’s recent earnings report, which exceeded predictions across the board, showcases a paradox in its current market status. A remarkable 78% increase in revenue year-over-year, bringing the total to $39.33 billion, underscores the company’s ongoing potential within the AI sector. Particularly, its data center revenue surged an impressive 93% from the previous year, nearing $36 billion. Nvidia’s strong performance serves as a reminder of the critical role it plays in powering AI workloads with its leading graphics processors.

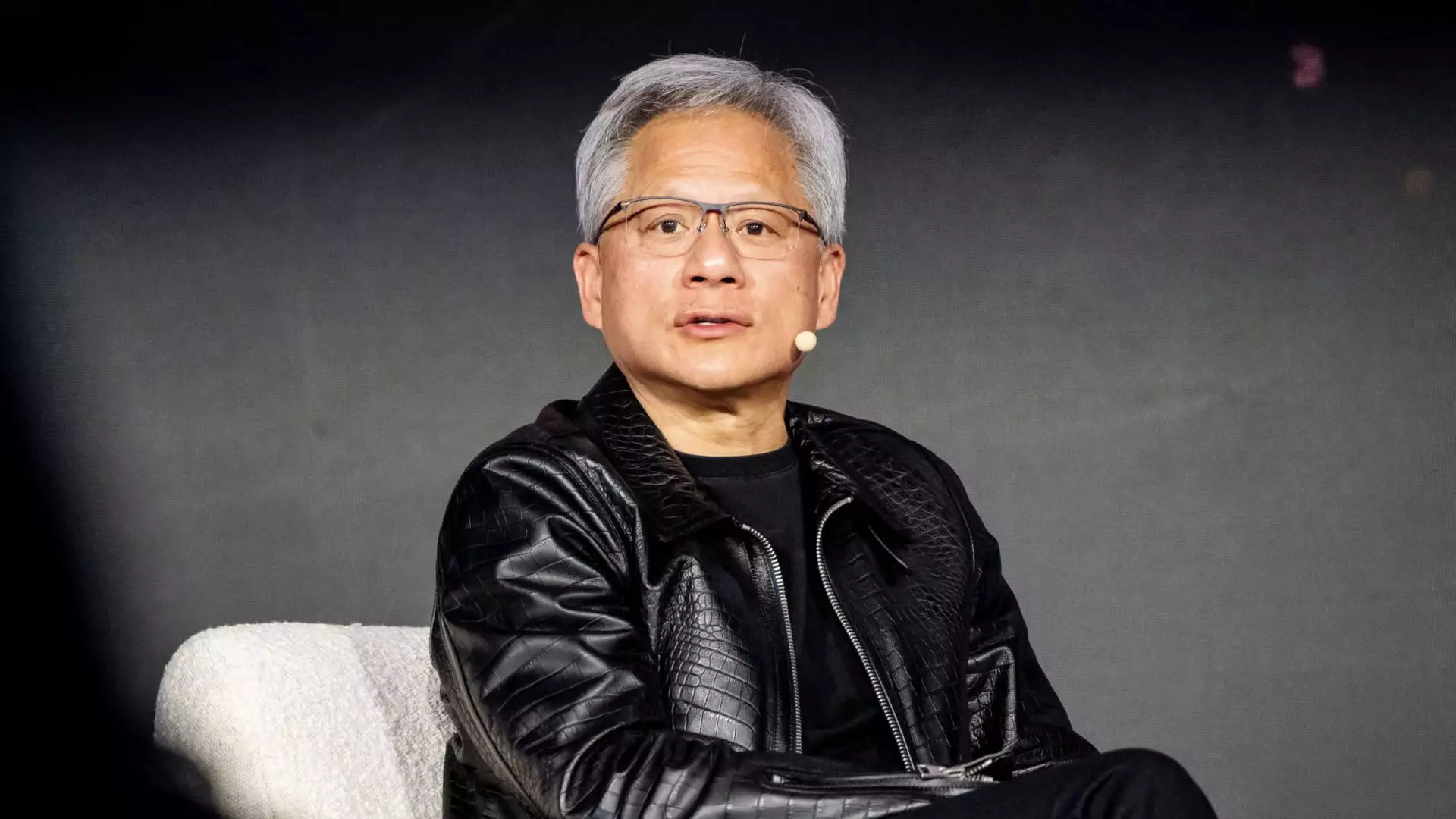

However, the market’s reaction indicates that investors remain cautious. Despite the positive earnings, concern lingers around Nvidia’s future challenges, notably those related to production capabilities for its upcoming Blackwell chip. Nvidia’s CEO Jensen Huang remains optimistic, revealing the anticipated demand for enhanced computing power required by next-generation AI models. The potential for these models to perform complex reasoning operations necessitates immense advancements in computational capabilities.

A significant aspect of Nvidia’s revenue structure revolves around its collaborations with major cloud service providers like Microsoft, Google, and Amazon. These enterprises contribute to about 50% of Nvidia’s data center revenue, establishing the company’s dependency on lucrative contracts with industry leaders. This interdependence signifies both opportunities and risks, as changing dynamics within the cloud services market could substantially impact Nvidia’s earnings in the future.

In closing, while Nvidia remains a formidable player in the tech milieu with promising growth metrics, it must navigate a complex landscape filled with potential pitfalls. Investor scrutiny, regulatory risks, and reaching sustainable growth post-2025 will be paramount for Nvidia to maintain its competitive edge, especially in a rapidly evolving sector dominated by innovation and fierce competition.

Leave a Reply