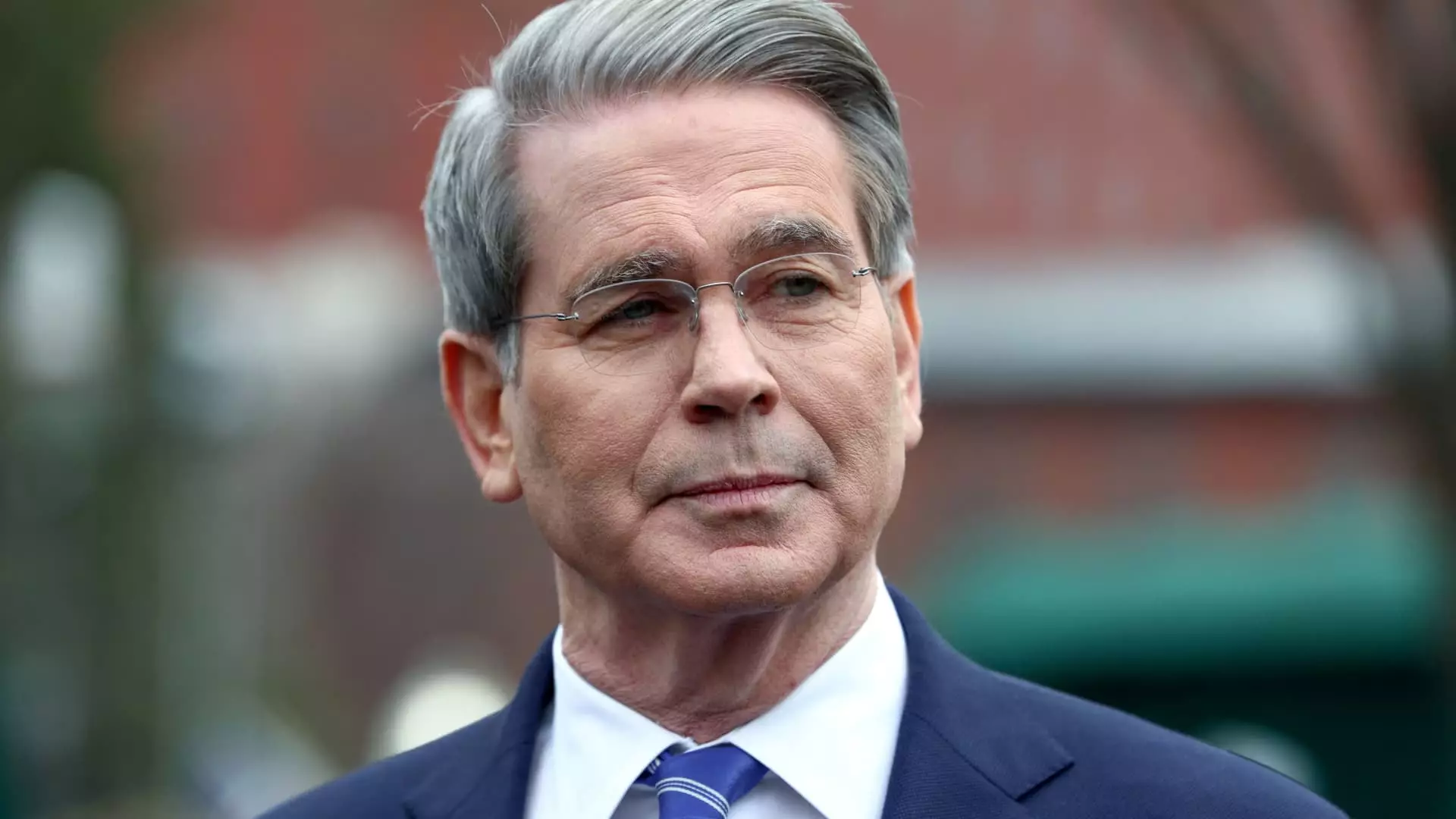

Recent discussions surrounding the U.S. economy have been laden with contradictions, as Treasury Secretary Scott Bessent attempts to assuage public concerns over the imminent threat of recession. Such a position, cloaked in confident rhetoric, is both audacious and misleading. Bessent’s dismissal of the anxiety many Americans experience about their retirement savings is telling of a deeper disconnect between the administration’s economic outlook and the realities faced by ordinary citizens. To characterize the apprehensions of those nearing retirement age as a “false narrative” trivializes their legitimate concerns, particularly when grappling with the fluctuations of the stock market—a volatile entity that can dramatically alter financial landscapes overnight.

The Long-Term View: A Double-Edged Sword?

Bessent champions a long-term perspective on investment strategies, a sentiment that many seasoned investors may agree with. However, the implications of such a stance can often border on unrealistic optimism, especially when the economic context alters significantly within short periods. While it is true that historically, markets tend to recover from downturns, this assertion does little to comfort those who rely on savings accumulated over decades. For them, day-to-day and week-to-week fluctuations are no trivial matter; they represent real stakes in a game where calculations have profound personal consequences. The idea that “most Americans don’t have everything in the market” seems dismissive of the very real dependency many families have on their investment portfolios for future stability.

Market Reactions: Reality Check Needed

The assertion that markets consistently underestimate President Trump’s actions, articulated by Bessent, lacks a substantive grounding in the current economic reality. Concerns over tariffs, particularly those as steep as 54% imposed on major trading partners, are not merely academic exercises; they evoke tangible fears of inflation spikes and job losses, fears exacerbated by the stock market’s sudden heart flutters following Trump’s announcements. Bessent’s claims are reminiscent of the kind of gaslighting often leveraged in political discourse, hoping to paint a rosy picture amidst looming economic clouds while undermining the valid sentiments of citizens who are justifiably worried about their futures.

The Historical Parallel: Simplifying Complexity

Bessent’s invocation of Reagan-era economic policies to endorse the current administration’s approach is an oversimplification of historical complexities. While it is true that the economic struggles of the 1980s gave way to pivotal policy changes, the multifaceted nature of today’s economy cannot merely be mapped onto the past. Today’s economic landscape is not only nuanced by global interdependencies but is also severely impacted by unprecedented challenges such as the COVID-19 pandemic, supply chain disruptions, and geopolitical tensions. To suggest that the current uncertainty can easily navigate through echoes of history feels naive and dangerously misleading. Such historical comparisons risk ignoring the unique circumstances that necessitate more thoughtful and rigorous policy responses.

Trade Dynamics: A Nuanced Discussion Needed

Bessent’s narrative about the “unsustainable system” of trade and the purported advantage taken by trading partners paints a stark but one-dimensional picture. Yes, trade deficits can indicate shortcomings in domestic economic strategy, but sweeping generalizations about trading partners taking advantage of the U.S. obfuscate the complex realities of global trade dynamics. To engage meaningfully in economic discourse, we must shift from a binary portrayal of “us versus them” to a more nuanced understanding of mutual interdependence. Such an understanding is essential for crafting policies that will lead to genuinely sustainable economic practices rather than invoking isolationist sentiment.

Building Trust and Transparency

In times of economic uncertainty, the need for clear, trustworthy communication from leaders becomes paramount. Statements like Bessent’s may appeal to those wishing to maintain optimism, but they ignore a critical element: the people’s voices. Failing to acknowledge the severity of economic malaise among ordinary citizens can lead to a breakdown in trust, as people ultimately require more than platitudes— they seek authentic engagement and viable solutions. In the fast-evolving economic landscape, it is imperative that leaders engage honestly, transparently, and with a measured understanding of the pulse of the nation’s concerns. Only then can we begin to construct the resilient economic framework that Bessent advocates, rather than relying on a veneer of false confidence that can easily shatter in the face of reality.

Leave a Reply