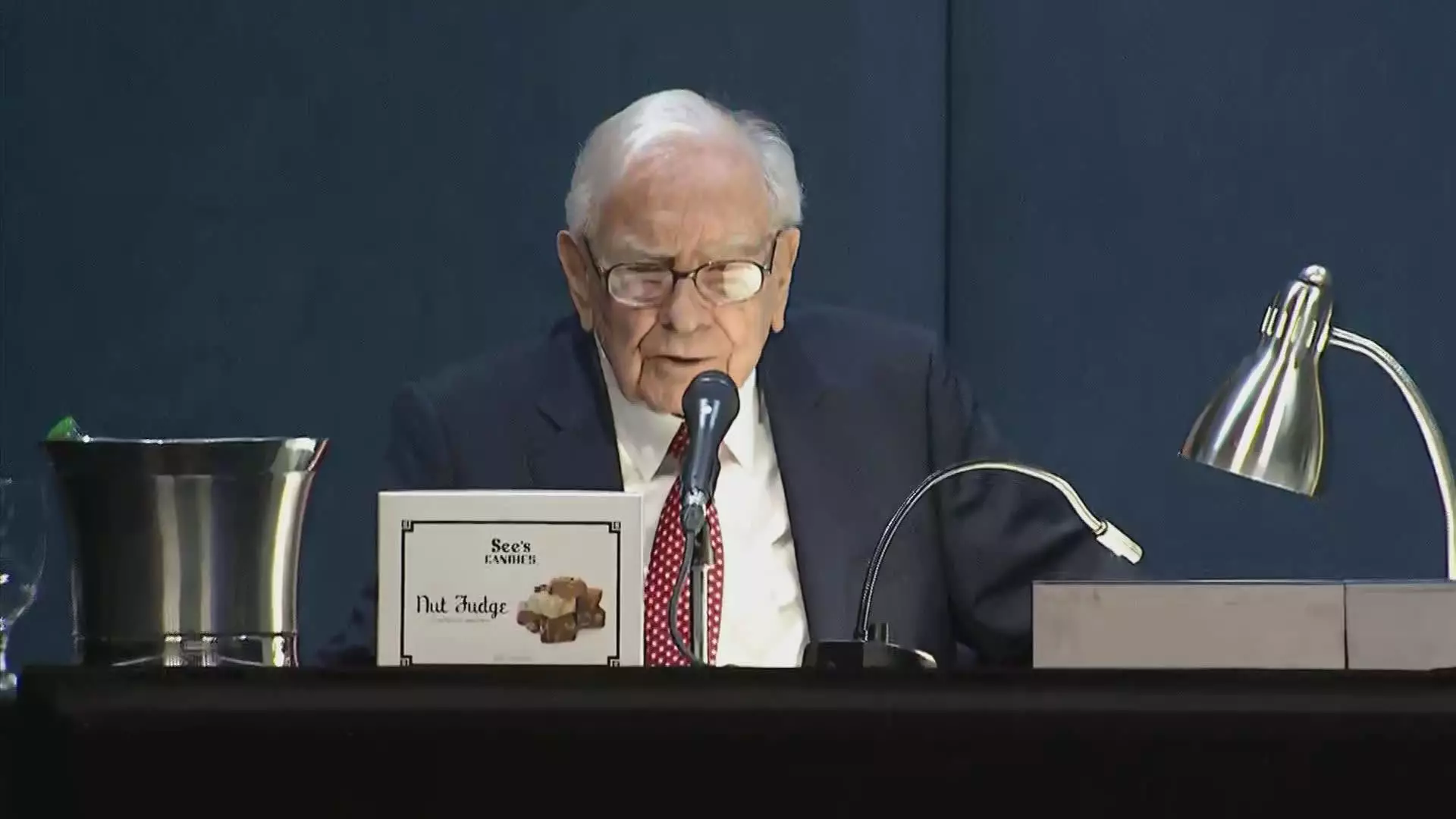

In recent weeks, the financial world has been rocked by a series of unpredictable events, most notably the aggressive trade policies introduced under President Donald Trump’s administration. While the stock market, particularly the S&P 500 and tech-heavy Nasdaq, has endured significant setbacks, Warren Buffett’s Berkshire Hathaway has showcased remarkable resilience. This divergence raises critical questions about the broader implications of market behavior when faced with political uncertainty and indicates a fascinating dynamic in investor sentiment towards solid, cash-rich entities like Berkshire.

A noteworthy aspect of this market turmoil is how investors have transitioned their allegiances amid economic turbulence. With the S&P 500 experiencing a staggering 9.1% selloff and the Nasdaq plummeting even deeper, Berkshire Hathaway managed to limit its losses to merely 6.2%. This adaptive response highlights a crucial turning point for investors re-evaluating their positions: a flight to safety. Berkshire’s diverse portfolio—spanning from robust insurance enterprises to significant investments in energy and retail—positions it as a sanctuary for wary investors seeking refuge from the unpredictable storms of the market.

Cash Reserves as a Strategic Advantage

Another influential factor in Berkshire’s continuing success lies in its intimidatingly high cash reserves. As of the end of 2024, the conglomerate boasted an astonishing $334 billion in cash—an asset that provides security and flexibility in the face of looming economic uncertainties. In an era where volatility reigns supreme, having such a financial cushion empowers Berkshire to weather downturns and seize opportunities that competitors might overlook.

But it’s not just cash that defines Berkshire’s strength; it is also the strategic vision of Buffett himself. As a leader with decades of experience navigating economic upheaval, Buffett’s approach exemplifies the kind of prudent management required in uncertain times. Investors recognize that Berkshire Hathaway’s performance is less tethered to immediate political developments and more aligned with the underlying health of the U.S. economy.

The Value of Independence

One of the critical insights emerging from this scenario is the notion of market independence. Berkshire Hathaway operates in a sphere that’s relatively insulated from the erratic nature of the current administration. Observations from financial experts, including Ritholtz Wealth Management’s CEO Josh Brown, emphasize that Berkshire does not rely on the whims of political discourse for its survival or growth. Companies that are more closely aligned with the whims of Washington, embodying sectors greatly influenced by regulatory changes, may find themselves far more vulnerable to the tides of political fortune.

In fact, this has sparked a rigorous re-evaluation among investors of which stocks to hold amid the unrest. While many high-flying tech stocks stumble, the reassuring stability of Berkshire Hathaway earns it a distinctive place of preference. The ability to stand firm when compared to giants faltering under pressure speaks volumes about its market position and investor trust.

My Take on Market Dynamics

As a centrist liberal, I view the stark contrast in responses between companies like Berkshire and their more politically exposed counterparts as indicative of broader systemic issues in the economy. The ongoing trend of politicians impacting market performance underscores the necessity for fiscal policies rooted in sustainability rather than knee-jerk reactions. True economic resilience stems not merely from maintaining strong cash reserves, but rather from fostering an environment that promotes long-term stability through responsible governance.

The rise and fall of stocks should ideally reflect the inherent value and potential of companies rather than their proximity to political favor. The resilience of Berkshire Hathaway reminds us that successful business operations must be able to transcend political ideologies, while a shift in investor behavior showcases a maturing market perception rooted in substance rather than spectacle.

As the waters of financial uncertainty continue to churn, one can only hope that lessons learned from the current atmosphere lead to a more measured and forward-thinking approach in both business and politics, emphasizing connection with the economic landscape—rather than pandering to the political arena.

Leave a Reply