Goldman Sachs has introduced a new concept of stock baskets based on corporate asset intensity, defined as the ratio of assets to revenues. This innovative approach has led to the creation of two distinct baskets – one consisting of asset-light stocks and the other comprising asset-heavy stocks. According to Goldman Sachs, the asset-light stocks have outperformed the high-asset intensity group by 40 percentage points since 2002. This significant outperformance can be attributed to the superior return on equity of the asset-light cohort, which stands at 22% compared to 15% for the asset-heavy group.

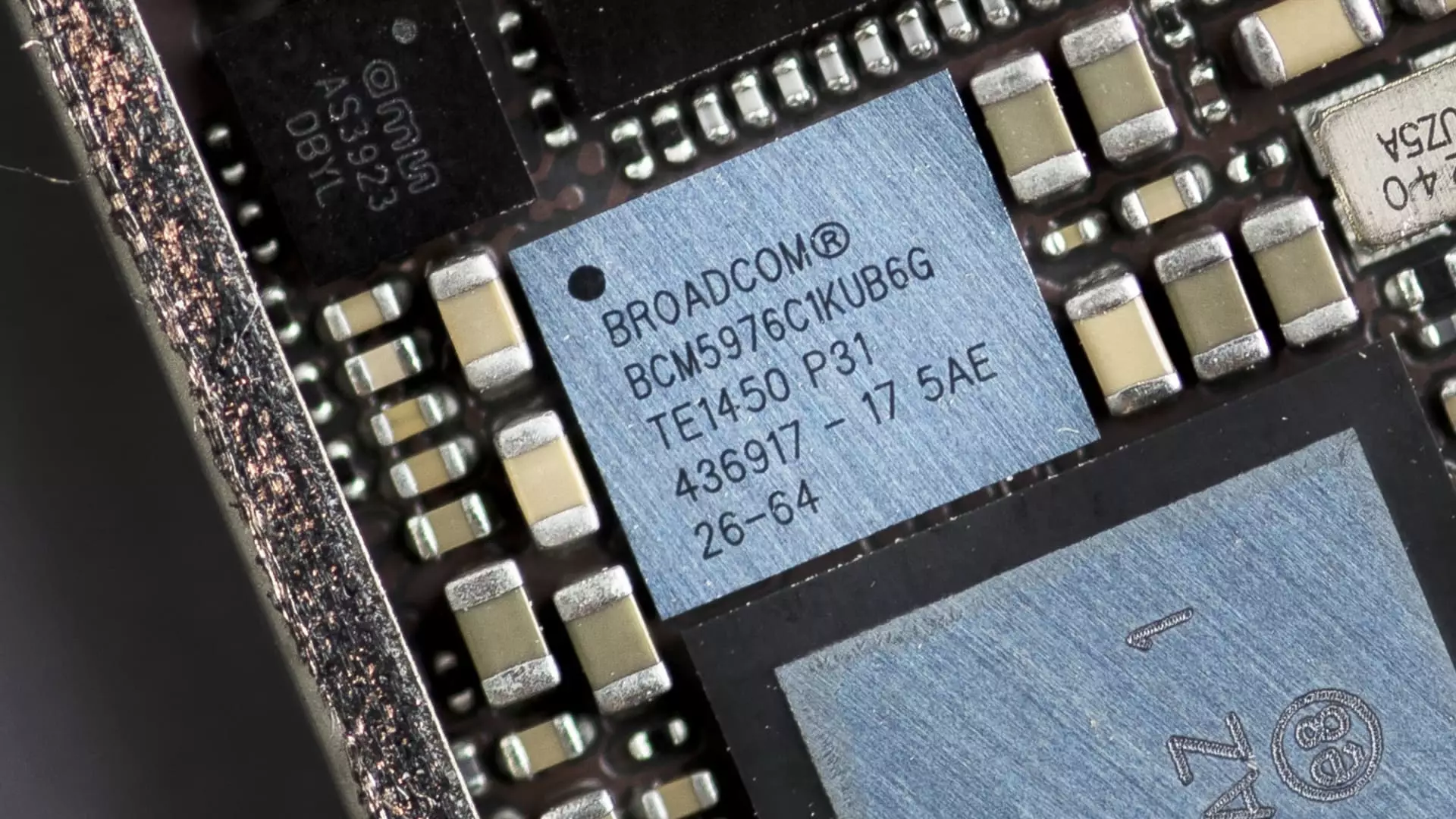

One of the asset-light companies highlighted by Goldman Sachs is Nvidia, a semiconductor giant with an asset intensity ratio of just 0.5. Despite having the highest year-to-date return of 73.1% and a consensus 2024 earnings per share growth of 87%, analysts are cautious as the average price target suggests that share prices are at their peak. Another chipmaker in the basket is Broadcom, with a calculated asset intensity ratio of 0.3. While shares are up 27% in 2024 and consensus earnings per share growth is expected to be 19% higher than 2023, analysts predict that share prices are due for a 13% pullback from their current levels.

On the other hand, the asset-heavy companies in the S & P 500 include chipmakers Micron Technology, Intel, and On Semiconductor, as well as telecommunication services giants like AT & T, Verizon, and T-Mobile. These companies have higher asset intensity ratios and are expected to potentially outperform by around 100 basis points over the next 12 months as the cost of capital falls. Greater-than-expected capital expenditures could serve as a catalyst for the asset-heavy class, according to Goldman Sachs strategist Jenny Ma.

While asset-light companies have displayed impressive performance in the past, it is essential to consider the evolving market dynamics and potential headwinds that could impact their future growth. Similarly, asset-heavy companies may experience a resurgence in the coming months due to a changing economic environment. It is crucial for investors to conduct thorough research and analysis before making investment decisions based on Goldman Sachs’ stock baskets.

Goldman Sachs’ introduction of stock baskets based on corporate asset intensity has shed light on the importance of considering a company’s asset structure in investment decisions. While asset-light stocks have outperformed in recent years, the future landscape of the market remains uncertain, and investors must exercise caution when allocating capital. By conducting comprehensive due diligence and monitoring market trends, investors can make informed decisions and navigate the complexities of the stock market effectively.

Leave a Reply