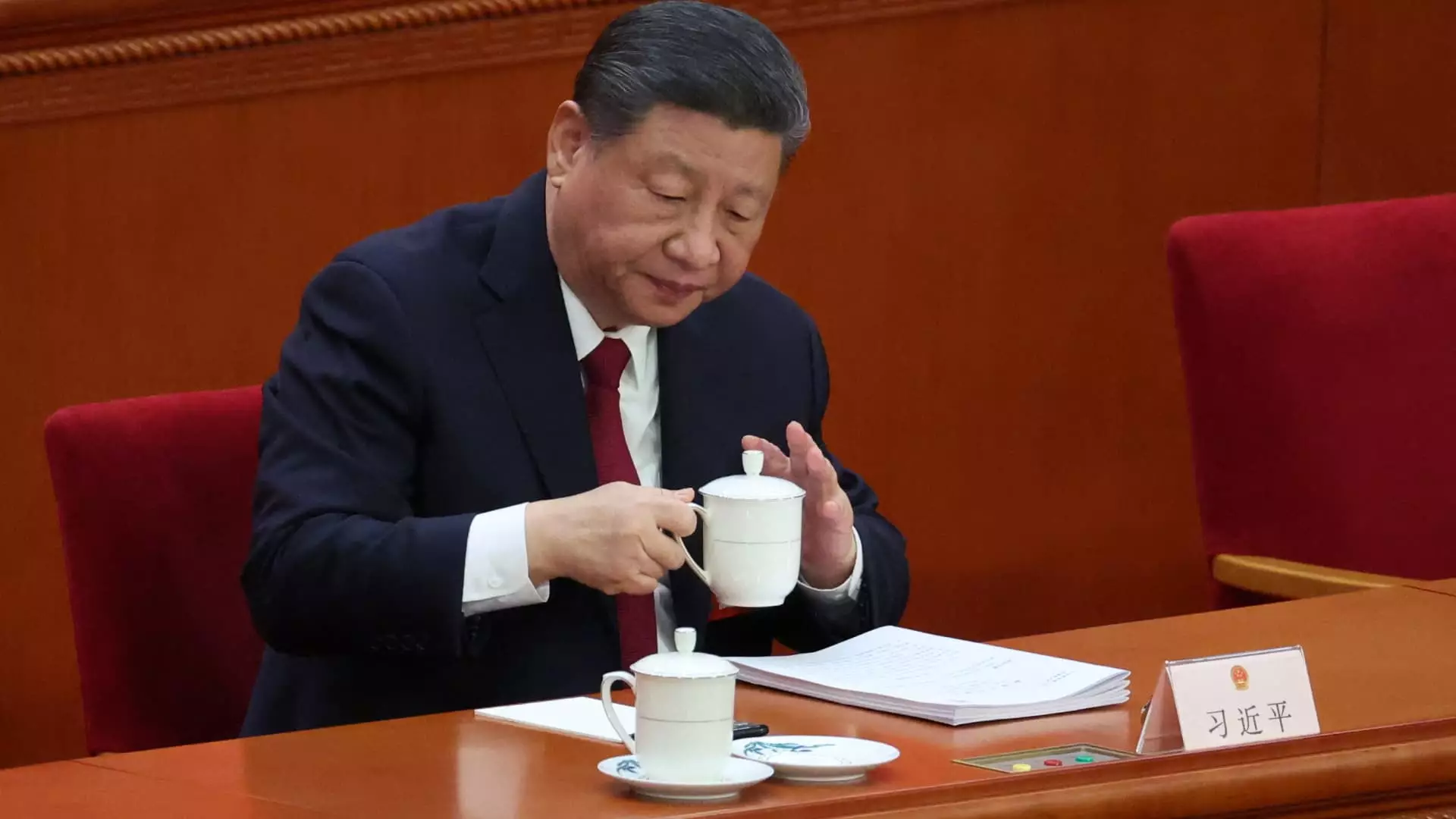

In a world increasingly defined by interdependence, China’s latest maneuvers in the face of mounting external pressures evoke a sense of urgency. President Xi Jinping’s recent meeting with the Politburo highlights a stark admission: even a behemoth like China is grappling with significant economic challenges. The announcement that the government will introduce targeted support measures for struggling businesses is a powerful indicator of the pressures plaguing the economic landscape. It reflects deep-seated vulnerabilities that are not merely tied to external shocks, but also the structural weaknesses that have long been sidelined in discussions of China’s unmatched growth story.

The trade war with the United States, characterized by a reckless tit-for-tat escalation in tariffs, serves as a crucial backdrop to this moment. It reveals the fragility of China’s economic resilience. The Chinese government has been forced to acknowledge that the lofty growth target of “around 5%” may be more aspirational than achievable under the current circumstances. Major Wall Street banks, armed with new data and realignment of their forecasts, are also signaling a sobering reality that could compound frustrations in Beijing.

A Band-Aid on a Hemorrhage: Addressing the Business Struggle

In the face of this economic maelstrom, the Politburo’s call for “multiple measures to help businesses in difficulty” suggests a tactical retreat from previously held certainty about growth. Financial support is likely to be the centerpiece of the upcoming strategies, but one must question whether these measures will penetrate deeply enough to foster meaningful recovery or are just another case of a government attempting to place a Band-Aid on a hemorrhage.

Moreover, policymakers’ emphasis on timely reductions in interest rates and reserves conjures up memories of quick fixes dressed as comprehensive solutions. While the measures appear well-intentioned, they risk being mere short-term salves rather than the injection of real, systemic change needed to steer China toward a more sustainable economic footing. A nuanced understanding of China’s economic fabric suggests that direct monetary or fiscal stimulus may not suffice to lift the economy out of its current predicament. A rethink of strategies that include addressing wealth inequality, investing in innovation, and improving market diversity is vital.

Market Response: A Mirror to Policy Effectiveness

Financial markets are telling another story altogether. The immediate reactions to the Politburo announcements provide insight into the perceived efficacy of these measures. The market downturn in response to the meeting’s readout symbolizes a deep-rooted skepticism about the government’s ability to navigate through these turbulent times. Such reservations pose questions about whether the policies being outlined will indeed be effective or if they are merely reiterating old narratives amidst unprecedented pressures.

With the impending review of a new private sector law by the National People’s Congress, one can only hope for a bold recalibration of China’s business environment. However, it remains to be seen if these legislative undertakings will penetrate the bureaucratic veil that often stifles ambition and innovation in the private sector. Genuine reforms, especially those empowering smaller enterprises and entrepreneurs, could form a sturdy foundation for resilience in the face of external shocks.

Middle-Class Empowerment: The Key for Sustainable Growth

Fundamentally, the Politburo’s focus on enhancing the income of middle and lower-income groups presents both an opportunity and a challenge. While the intention to boost services consumption indicates a shift toward a more consumption-driven economy, the real work lies in transforming this intention into action. The delicate balance of encouraging a robust middle class while addressing systemic inequalities is crucial for sustainable growth.

In this context, one must return to the integration of technology and innovation. The commitment to further tech development, including the integration of artificial intelligence, may serve as a dual-edged sword. On one hand, it holds tremendous potential for economic upliftment; on the other, it risks exacerbating existing disparities if not approached equitably. Ensuring that the benefits of technological advancement reach every segment of society must be prioritized.

China stands at a critical juncture, grappling with both external pressures and internal dynamics. The decisions made in the coming weeks will not only shape the trajectory of its economic policies but also redefine what it means to be a resilient economy in a world rife with uncertainties. The time is ripe for bold, inclusive reform—anything less risks stifling the very ambitions China seeks to uphold.

Leave a Reply