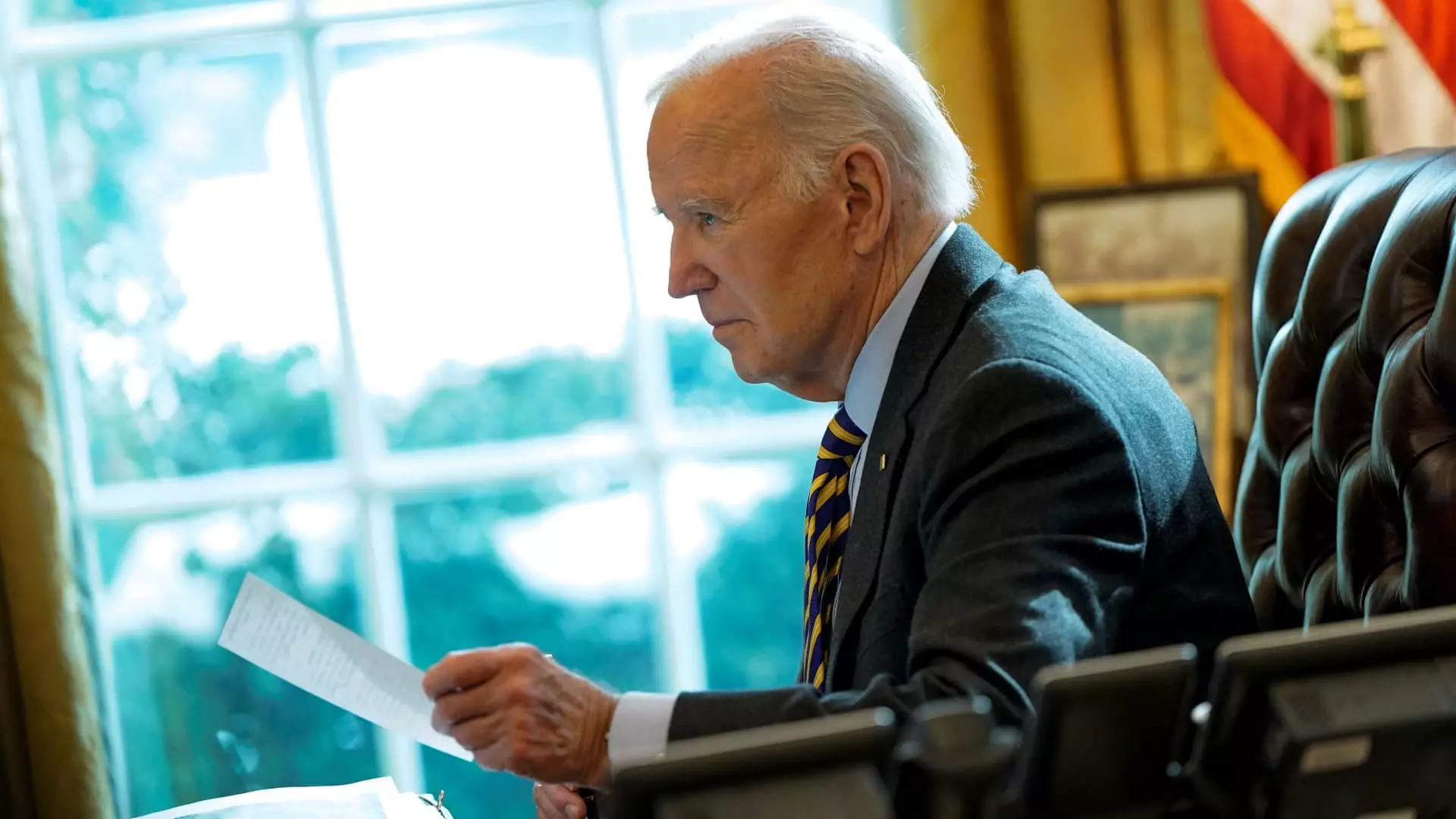

The landscape of international corporate acquisitions is often fraught with intricate layers of political, economic, and strategic considerations. The recent decision by the Biden administration to delay Nippon Steel’s $14.9 billion bid for U.S. Steel until June brings to light the complexities at play in such cross-border transactions. This move, stemming from national security concerns, encapsulates the balancing act that governments must perform in scrutinizing foreign investments while simultaneously fostering economic relations. The intricacies of this case reveal not only the practical implications for the U.S. steel industry but also the broader geopolitical dynamics that influence investor confidence and international partnerships.

The Biden administration’s block on the acquisition stands on the assertion of national security. This is a compelling rationale, particularly in industries like steel that are vital for defense manufacturing and infrastructure. The Committee on Foreign Investment in the United States (CFIUS), which conducted a comprehensive review of the bid before the presidential decision, typically evaluates foreign investments for potential risks to national security. In this case, the decision was contentious, with both parties suggesting that Biden’s longstanding opposition prejudiced the review process. For Nippon Steel and U.S. Steel, the ruling raises significant questions about fair treatment under U.S. law, especially when they argue for a thorough reconsideration of their merger proposal.

The legal ramifications of advancing this merger are profound. Not only do Nippon Steel and U.S. Steel seek to challenge the CFIUS review in court, but they also express a desire for a fair and impartial reassessment to potentially close the merger. This legal dispute will play a crucial role in determining the ultimate fate of the proposed acquisition and could set a precedent for future foreign investments in the U.S. The extended timeline—now set to June 18, 2025—grants the courts time to deliberate on the legal objections raised by the two companies. This situation underscores the significance of both legal frameworks and executive powers in shaping the economic landscape.

Moreover, the political landscape surrounding this merger cannot be ignored. President Biden’s initial opposition to the bid aligns him with labor advocates and union members who have voiced concerns regarding foreign ownership of American manufacturing assets. The historical context reveals an overarching narrative in which both major political parties have utilized national security arguments to block foreign acquisitions, particularly from Japan—a key ally—while seeking to galvanize union support. This intertwining of politics, economics, and labor interests shapes the environment in which such decisions are made, complicating the narrative behind corporate mergers.

Japanese officials are keenly aware of the ramifications of Biden’s blockade. Foreign Minister Takeshi Iwaya has publicly expressed regret over the decision, illuminating the broader Japan-U.S. relationship. Japan’s deep-rooted investments in the U.S. economy demonstrate the intricacies of bilateral relations. Iwaya’s remarks reflect not only Japanese government concerns but also a sense of urgency to reassure the business community that the U.S. remains an accessible market for foreign investors. The ramifications of these diplomatic relationships are crucial, as they impact the perception of risk associated with investing in the U.S., particularly in light of the CFIUS scrutiny.

As the June deadline approaches, all eyes will be on the evolving narrative of the Nippon Steel and U.S. Steel acquisition attempt. This case exemplifies a unique intersection between national security, political interests, legal frameworks, and international relations. The corporate landscape is evolving as stakeholders from both companies remain hopeful about the potential resolution. Yet, the path forward remains riddled with uncertainties, as union voices and national interests continue to exert considerable influence over the outcome. Ultimately, the fate of this acquisition will signal not only the future for these companies but will also redefine the parameters within which foreign investments are navigated in an increasingly complex global economic environment.

Leave a Reply