The realm of online prediction markets is once again stirring, as Polymarket anticipates a re-entry into the U.S. market, having captivated bettors with its foresight during the recent elections. With historical ties to the political landscape, this platform is not just a gambling site but a barometer for electoral outcomes, skillfully blending financial stakes with political forecasts. Such a resurgence raises questions surrounding the legitimacy and implications of market-based predictions.

Polymarket’s founder and CEO, Shayne Coplan, has been vocal about the challenges and triumphs in legalizing political prediction markets in the U.S. His acknowledgment of the collective effort to pave paths for these platforms highlights a crucial narrative: the importance of regulatory frameworks in fostering innovation. After halting operations in 2022 due to regulatory scrutiny and incurring a $1.4 million settlement with the Commodity Futures Trading Commission (CFTC), the company’s efforts to navigate the legal labyrinth could serve as a roadmap for similar enterprises looking to enter the space responsibly.

This past year marked significant changes in the regulatory landscape, particularly with U.S. Appeals Court rulings favoring prediction market competitors like Kalshi. These adjustments not only relieve legal pressures but also ignite optimism within the marketplace. The appeal went beyond simply lifting a freeze; it underscored federal acknowledgment of prediction markets as integral to a broader financial discourse.

Polymarket isn’t stepping back into a vacuum; it faces burgeoning competition from platforms like Interactive Brokers and Robinhood, which have also launched their election contracts. These corporate entities have taken notice of the burgeoning appetite for political betting, with leaders like Thomas Peterffy claiming that this sphere could eclipse even traditional equity markets within a decade and a half. Such predictions only serve to heighten the competition among platforms, likely driving innovation and creating new betting products.

As these companies embrace their entry into the prediction marketplace, they bring a blend of user-friendly interfaces and robust liquidity, striving to capture a growing audience intrigued by the interplay of finance and politics. The juxtaposition of these new entrants with Polymarket emphasizes the rapid evolution of prediction markets from niche interests into mainstream financial instruments.

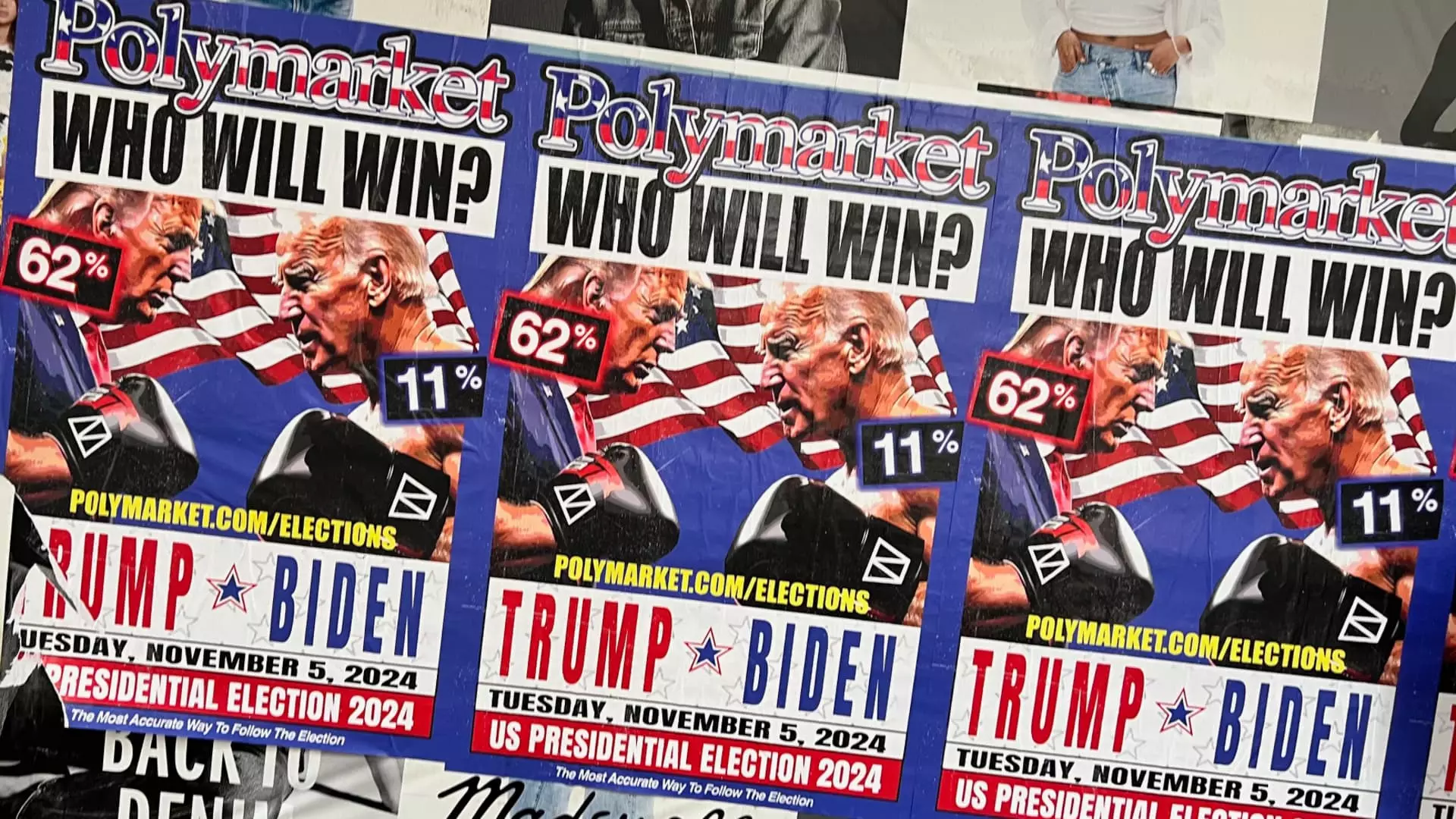

The dynamics of political betting markets were acutely showcased during recent elections, where Polymarket, among others, demonstrated notable predictive accuracy. Betting volumes soared, with Polymarket reportedly reaching nearly $3.7 billion in trading for the presidential race. As individuals wager substantial amounts, the implied accuracy of these markets appears to outstrip traditional polling methods. This invites a deeper evaluation of the reliability of polling data, often fraught with bias and methodological flaws.

Discussion surrounding the efficacy of monetary stakes in improving predictive accuracy is gaining traction. Notably, industry leaders like Vlad Tenev of Robinhood assert that financially invested players have more motivation to remain informed and make sound judgments. This dialogue suggests that traditional methods of gauging public sentiment might be nearing obsolescence in favor of market-based predictions driven by real economic implications.

The rise of platforms like Polymarket signifies not merely an economic opportunity, but a broader cultural transformation in political engagement. As citizens increasingly turn to prediction markets for insights rather than conventional media outlets, they shift the Onus of political understanding—from passive reception of information to active participation in the electoral narrative.

Shayne Coplan’s reference to “a complete shift in the Overton window” resonates on multiple levels. It suggests that we are witnessing an evolution in societal norms around what is permissible to discuss or wager upon. The political betting market is mapping out a new frontier, where the barriers between governance, finance, and public interest begin to converge.

As Polymarket prepares to reintegrate into the U.S. market, it enters a landscape rife with potential yet laden with challenges. The implications of its operations extend well beyond betting, heralding a new era of engagement and interaction with civic realities, ultimately reshaping how information manifests in the political sphere. As these dynamics unfold, the landscape of prediction markets will undoubtedly continue to evolve, placing even greater significance on the intersection of finance and democracy.

Leave a Reply