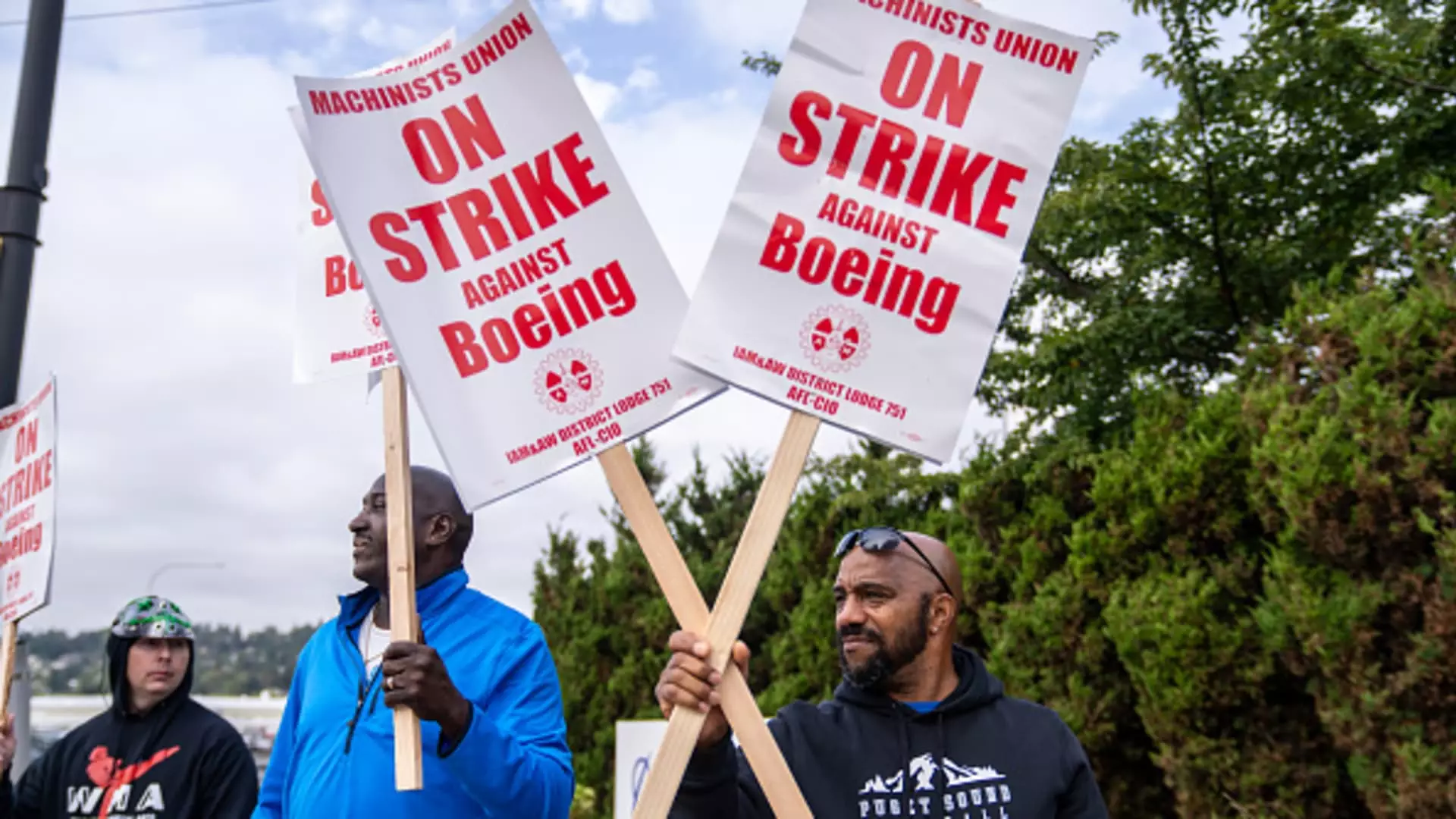

Boeing is experiencing a tumultuous period, grappling with an active strike involving over 30,000 machinists who have rejected a tentative contract agreement. As the effects of this labor dispute ripple through the company, there are broader implications for Boeing’s financial standing, production schedules, and market reputation.

The Fallout from a Failed Negotiation

The strike, initiated after a resounding 95% of union members voted against the proposed contract, has exacerbated an already challenging year for Boeing. The rejection signals not only dissatisfaction among the workers regarding pay and benefits but also the precarious state of the aviation industry as a whole. S&P Global Ratings estimates the strike is costing Boeing upwards of $1 billion monthly, an enormous financial burden that compounds the manufacturer’s existing challenges that began with a near-failure in its 737 Max program.

Boeing’s new CEO, Kelly Ortberg, finds himself amidst a crisis, compelled to navigate uncharted waters mired in controversy and operational difficulties. The strike threatens to stall production not only at Boeing’s primary facilities in Seattle but also across its national network. As workers are sidelined, the immediate impact is a significant drop in cash inflows for a company already teetering on the brink of financial instability.

The breakdown of negotiations has led to tensions escalating between Boeing management and the International Association of Machinists and Aerospace Workers (IAMAW). In a recent turn of events, Boeing accused the union of negotiating in bad faith, raising accusations that only deepen mistrust between both parties. Jon Holden, president of the striking union, has urged the company to engage in meaningful negotiations rather than resorting to intimidation tactics. The call for resolution reflects a growing need among employees for clarity and compensation that aligns with their industry contributions.

Yet the path to resolution remains unclear. Experts suggest that while union demands, particularly regarding a return to a pension plan, may prove difficult to achieve, Boeing must significantly alter its current offer to avoid prolonging the strike. Failure to find common ground quickly could result in lasting damage to employee morale and the company’s workforce planning.

The consequences of the strike extend far beyond the immediate labor dispute. With the cessation of production, Boeing’s operational capacity is severely limited, posing risks to its commitments to airline customers. Moreover, the company is also facing external market pressures. Investors are deeply concerned as Boeing’s shares have plummeted by 42% this year alone—the sharpest decline since 2008—leading several analysts to warn of an impending downgrade to junk status.

The financial report due on October 23 will serve as Ortberg’s first significant test with investors as CEO, a daunting task given the backdrop of anticipated losses climbing towards $10 per share for the third quarter. There is speculation about possible job cuts across the global workforce, which could amount to 10%, including reductions in managerial positions.

Boeing’s current challenges highlight how interconnected the aerospace supply chain is, emphasizing risks for suppliers like Spirit AeroSystems, which is contemplating furloughs for its staff due to Boeing’s uncertain production timelines. The ramifications of the strike could create a domino effect, potentially disrupting the stability of the entire aerospace industry.

In an environment where workforce stability is vital, Ortberg’s approach must not only tackle the pressing need for financial recovery but also address ongoing labor relations. The insistence on cost-cutting measures should not overshadow the importance of investing in a committed and skilled workforce. A balanced strategy that ensures employees feel valued and secure will be essential for turning Boeing’s fortunes around.

The road ahead for Boeing is fraught with complications, and while negotiations resume, the outcome of this labor dispute will have long-lasting consequences on the company’s trajectory, employee trust, and its standing in the increasingly competitive aerospace landscape. Whether Ortberg can lead the organization towards a constructive resolution remains to be seen, but immediate action is critical for healing the rift and restoring the confidence of both employees and investors alike.

Leave a Reply