The financial markets have witnessed a notable shift in investor sentiment, particularly in the technology sector, following the Federal Reserve’s pivotal decision to reduce its benchmark interest rate. This article delves into the implications of this monetary policy adjustment, focusing on the dramatic stock performance of tech giants and the broader trends influencing investor behaviors.

On a day marked by significant market movements, tech stocks soared, resulting in one of the most impressive rallies of 2024. This phenomenon was primarily catalyzed by a 0.5% reduction in interest rates, the first such cut since 2020. Following this announcement, the Nasdaq Composite Index surged by 2.5%, showcasing its fourth-highest rally of the year. Leading the charge were prominent players like Tesla and Nvidia, whose shares rose by 7.4% and 4%, respectively. Such gains highlight how lower borrowing costs can create a favorable environment for tech companies, which often rely on substantial capital investments to fuel growth and innovation.

Lower interest rates typically invigorate tech stocks for several reasons. Reduced borrowing costs make it easier for companies in this sector to finance projects and new initiatives, while lower bond yields render equities more appealing compared to fixed-income investments. As a result, investors are more willing to embrace the risks associated with tech stocks, especially in an era characterized by rapid technological advancement. This particular market rally underlines the critical interplay between fiscal policy and investor psychology.

In a broader context, the Federal Open Market Committee’s communications suggested potential further cuts in the coming months, which could lead to a cumulative decrease of 2 percentage points by the year’s end. Such prospects excite investors, bolstering confidence in the growth trajectory of tech-heavy indices like the Nasdaq.

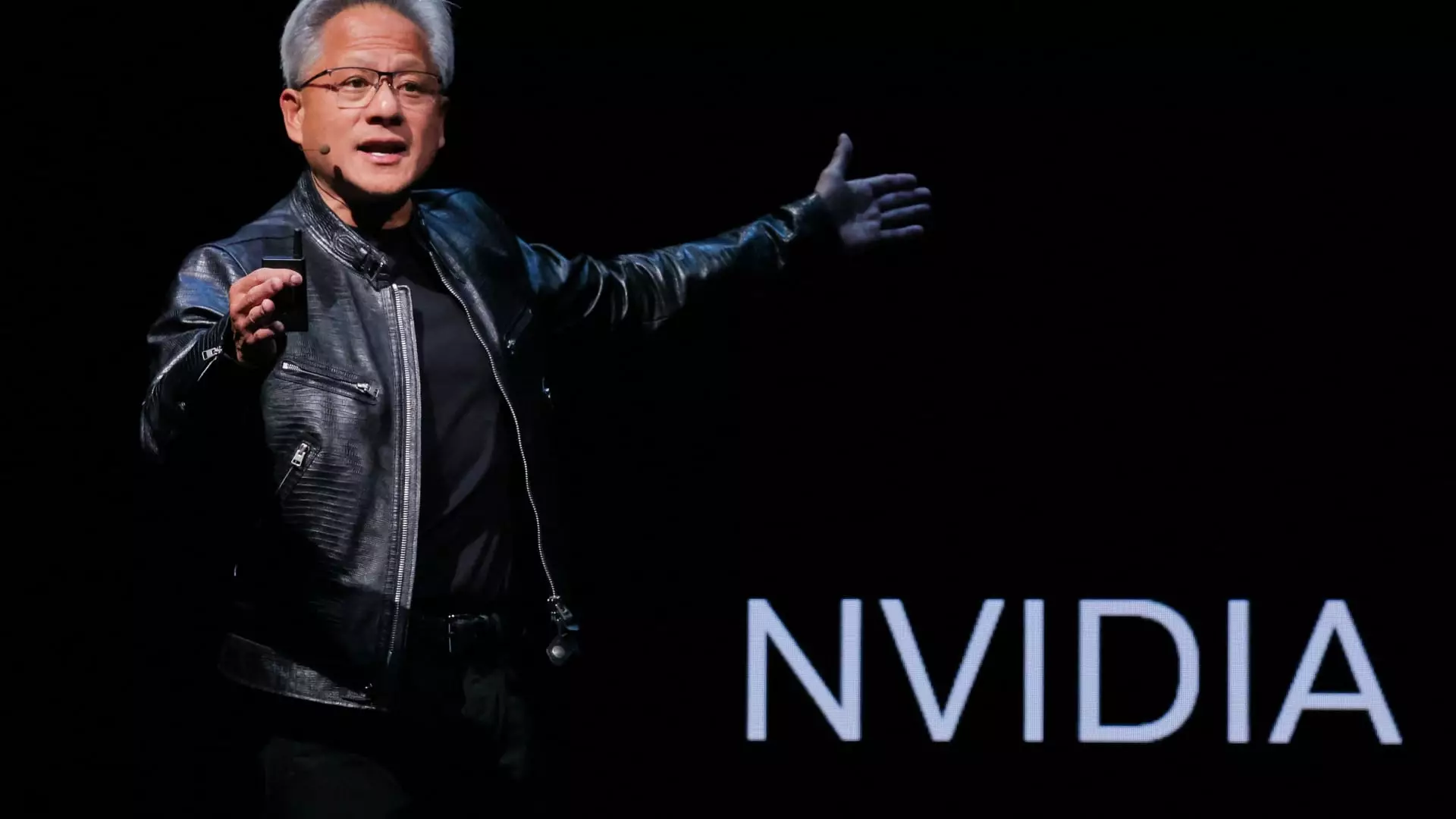

The spotlight remains on Nvidia, primarily due to its central role in the burgeoning artificial intelligence (AI) landscape. The company’s stock has seen an exponential increase, reflecting not only its dominance in graphics processing units (GPUs) but also its critical involvement in powering various AI applications, including those developed by industry leaders like Microsoft and OpenAI. Despite its impressive year-to-date performance, Nvidia’s current stock price still lags behind its historic highs, raising valid concerns regarding the sustainability of its growth, especially amid worries about an eventual deceleration in demand.

As Nvidia continues to monopolize the AI-driven hype, it’s worth noting that smaller competitors like Advanced Micro Devices (AMD) also aim to carve out their niches in this lucrative market. Although AMD has made strategic moves to compete with Nvidia, skepticism among investors lingers as the company boats only modest growth. AMD’s CEO, Lisa Su, aptly emphasizes that advancements in AI are a long-term endeavor, suggesting that impatience may lead to misguided expectations in a highly volatile market.

Against the backdrop of a broader tech upswing, companies like Tesla, Apple, and Meta have also seen their stocks perform admirably. Tesla, despite facing regulatory scrutiny and industry competition, experienced a significant increase, rallying by 7.4% on a day where it needed a turnaround following a lackluster year. The company’s ability to rebound illustrates the resilience inherent in the tech sector, driven by ongoing consumer interest in electric vehicles and sustainable technologies.

Similarly, Apple and Meta also contributed to the tech sector’s bullish behavior, each posting gains of roughly 4%. This collective rise among major players suggests an overarching optimism among investors regarding the future of technology, underscoring the influence of interest rate policies on market dynamics.

The recent surge in tech stocks exemplifies the sensitive relationship between monetary policy and investor behavior. As the Federal Reserve navigates through economic uncertainties, its decisions continue to shape the landscape for technology companies. While the current optimism is palpable, the challenge lies in sustaining this momentum amid broader economic considerations. Investors would do well to remain cautious, as the landscape can shift rapidly in the ever-evolving realm of tech and finance.

Leave a Reply