As investors gear up for the trading day, the financial markets are exhibiting a positive trend. The S&P 500 recently enjoyed its fourth consecutive day of gains with a boost of 0.75%. This streak reflects an emerging investor confidence, particularly in technology stocks, as the Nasdaq Composite outperformed with a notable 1% increase. Meanwhile, the Dow Jones Industrial Average also showed resilience, adding 235.06 points—a climb of 0.58%. These movements come in anticipation of the forthcoming Federal Reserve meeting, where investors are closely watching the latest producer price index (PPI). This essential economic indicator provides insights into inflation by measuring the changes in wholesale prices, and its reporting of a 0.2% rise in August aligns with market expectations, offering a semblance of stability ahead of potential policy shifts.

In a significant development impacting one of the world’s leading aerospace manufacturers, over 30,000 Boeing employees have initiated a work stoppage. This strike follows a rejection of a tentative contract agreement with the International Association of Machinists and Aerospace Workers. The implications of this industrial action are profound, particularly since it halts production of Boeing’s best-selling aircraft, complicating the corporation’s recovery efforts after a series of setbacks. IAM District 751 President Jon Holden labeled this as an “unfair labor practice strike,” highlighting the underlying tensions in labor relations. Boeing’s leadership acknowledged the situation, stating their commitment to rebuilding ties with workers and reaffirming their readiness to negotiate further in hopes of resolving the discord.

In the tech sector, Adobe’s recent earnings report presented a tale of contrasts. While the third-quarter results exceeded Wall Street’s expectations for both revenue and earnings, the company’s cautious guidance for the fourth quarter led to an approximately 8% drop in share value during premarket trading. Analysts anticipated earnings per share of $4.67 on $5.61 billion in sales, but Adobe’s projections fell short with forecasts between $4.63 to $4.68 per share and revenue expectations of $5.5 billion to $5.55 billion. Despite the drop, Adobe did report an impressive 11% year-over-year increase in subscription revenue, reflecting strong demand for its digital media offerings. This juxtaposition of strong performance but conservative future guidance raises questions about market expectations and the potential impacts on tech valuations moving forward.

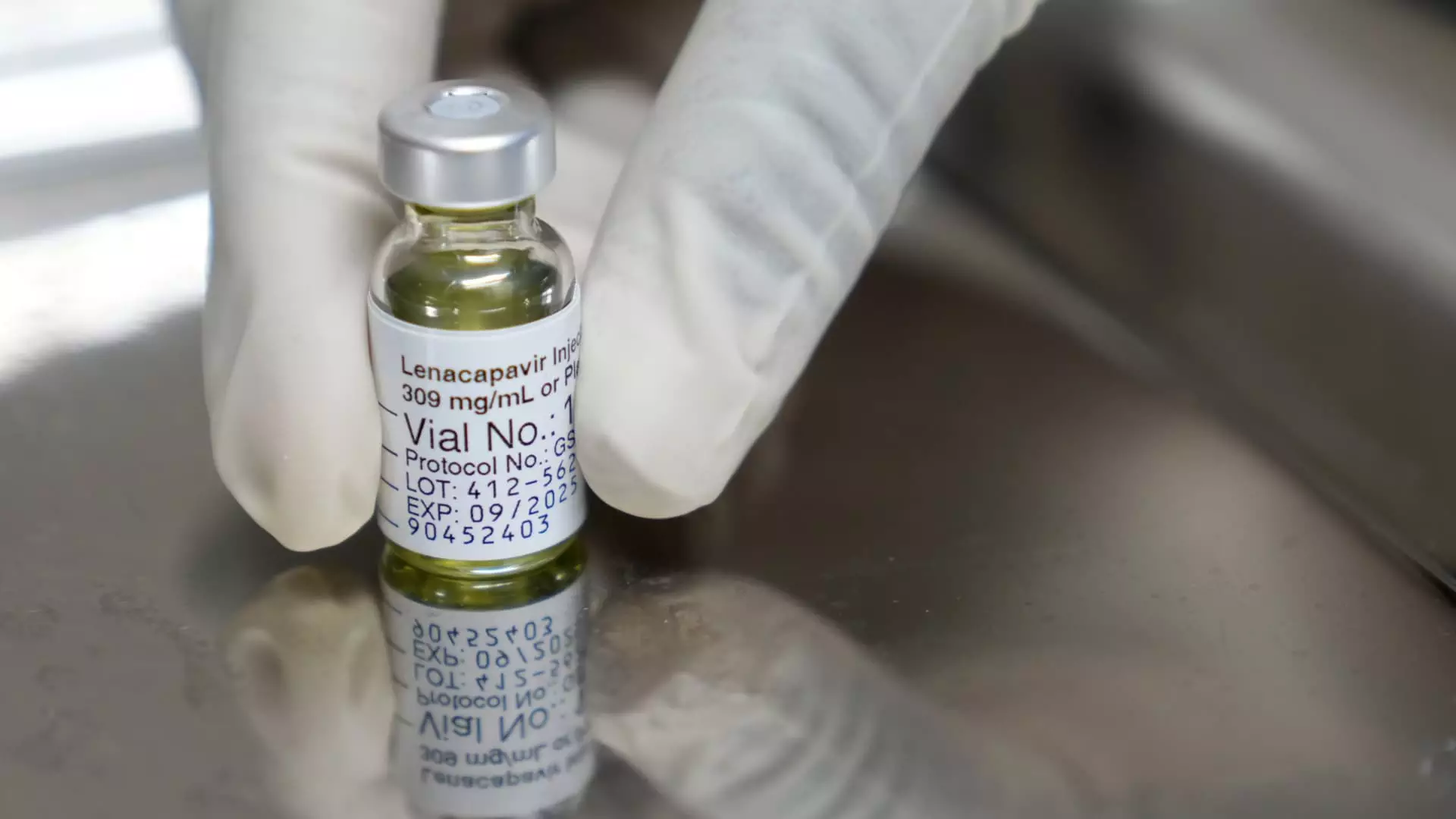

A Major Breakthrough: Gilead’s Progress in HIV Prevention

In the pharmaceutical arena, Gilead Sciences unveiled remarkable results from a recent trial investigating its twice-yearly injection, lenacapavir. The data showcased an impressive 96% reduction in HIV infections among participants, with only two cases reported among 2,180 individuals in the phase-three trial. This pivotal achievement not only highlights the efficacy of lenacapavir as a preventive measure but could also pave the way for the U.S. Food and Drug Administration’s approval of the drug for HIV prevention. As the medical community anticipates further developments, the implications for public health and pharmaceutical advancements are substantial, underlining the importance of innovation in combating global health issues.

As New York Fashion Week wraps up, significant discussions are heating up in the retail sector. Major players Tapestry, the owner of Coach, and Capri Holdings, the parent company of Michael Kors, are embroiled in legal discussions regarding their proposed $8.5 billion merger. Initially announced over a year ago, the merger faced opposition from the Federal Trade Commission, which argued that the consolidation could harm competition, inflate prices in the handbag market, and diminish employee benefits. The current courtroom proceedings are foundational, focusing on the competitive landscape in the handbag industry and the rationale behind the merger. As legal battles unfold, the outcome could reshape the dynamics of the luxury retail market and set precedents for future M&A activities.

Overall, these developments provide a rich tapestry of insights into various sectors influencing the investment landscape. Investors are advised to stay informed and consider how these dynamics may impact their strategies moving forward.

Leave a Reply