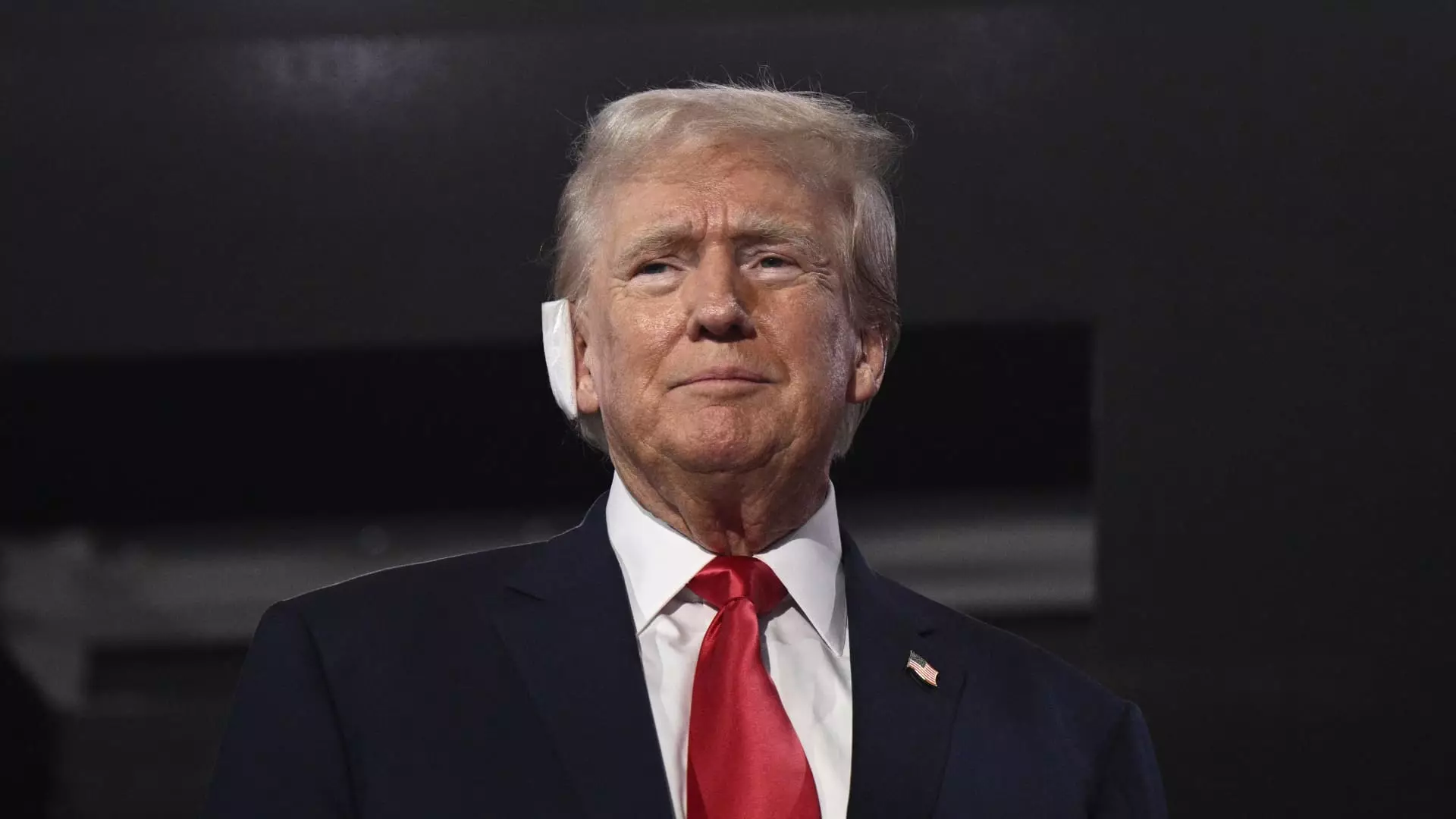

A potential second term for former President Donald Trump has raised concerns among analysts regarding the impact on global inflation. Trump’s America-first policies, characterized by high tariffs and low taxes, have the potential to drive up costs and lead to inflationary pressures not only in the United States but across the world.

Michael Metcalfe, head of macro strategy at State Street Global Markets, highlighted the risks associated with Trump’s policies in a second term. The current “inflation mindset” and higher inflation expectations could exacerbate the inflationary impact of Trump’s economic agenda. The combination of high tariffs on imported goods and tax cuts that boost consumer spending may result in higher prices for consumers both domestically and internationally.

The imposition of high tariffs by Trump, particularly on China, could have a significant impact on global trade. Economists have suggested that a second Trump term would likely lead to higher inflation due to his protectionist stance. This could result in price increases not only in the United States but also in Asia and Europe, as domestic producers raise their prices in response to higher import costs.

Analysts have predicted that a second Trump term could have a reflationary effect on the global economy. The combination of further tax cuts and increased tariffs could lead to a rise in inflation expectations, prompting higher interest rates. This could result in a bias towards curve steepening, indicating higher inflation expectations and potentially affecting financial markets.

The prospect of a Trump presidency is seen as a negative risk factor for Asian stocks. Analysts have warned that Trump’s policies could lead to increased inflation in the global economy, potentially causing supply chain shifts within Asia. Companies may need to diversify their production to mitigate the impact of higher tariffs and inflationary pressures.

Despite concerns over the economic implications of a second Trump term, his campaign has gained momentum following the Republican National Convention. U.S. stocks rallied in response to the prospects of his pro-business agenda. However, analysts caution that the rally may be short-lived, given uncertainties surrounding Trump’s protectionist trade policies.

The potential impact of a second Trump presidential term on global inflation is a significant concern among analysts. The combination of high tariffs, tax cuts, and inflationary pressures could have far-reaching effects on the global economy. As uncertainties loom over the future policies of the Trump administration, it is crucial for investors and policymakers to closely monitor the developments and prepare for potential changes in the economic landscape.

Leave a Reply