As we enter the second half of 2024, many stocks are positioned to outperform based on the analysis of Wall Street analysts. Despite the S & P 500 rallying over 15% and reaching record levels this year, there is still potential for further gains. Investment firms like Goldman Sachs, Evercore ISI, and Citi have all raised their year-end forecasts for the market index, indicating a positive outlook for the rest of the year.

When screening for stocks with the potential to outperform in the coming months, some names have stood out. These stocks have analyst price targets that suggest a 20% or more upside, and they are already showing positive performance in 2024. These price targets are based on 12-month estimates, providing a longer-term perspective for investors.

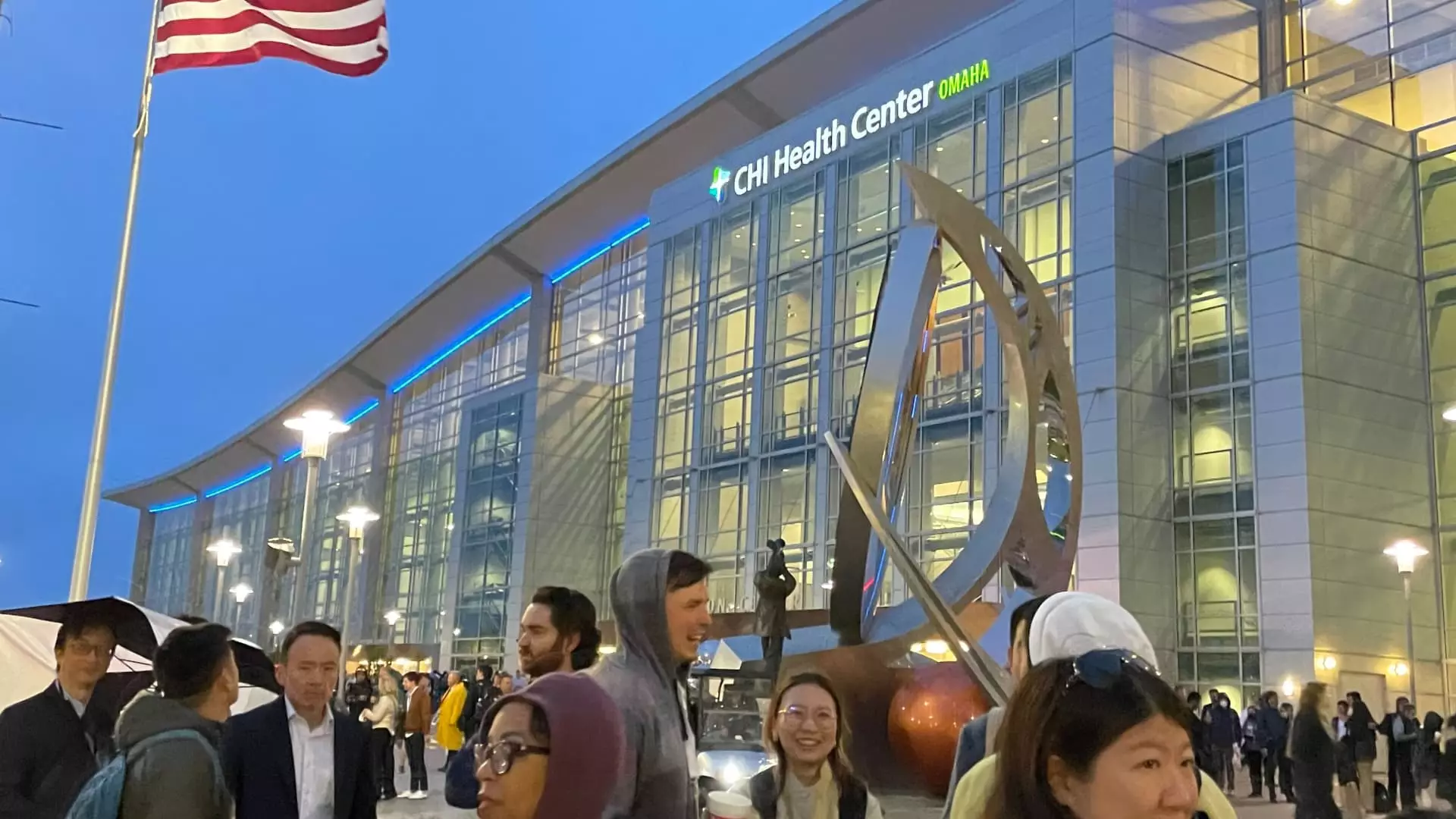

Warren Buffet’s Berkshire Hathaway is one of the top stock picks for the second half of the year. The Class B stock is projected to rise by 20.8% over the next 12 months and has already gained around 13% year to date. With three out of four analysts rating it as a buy or strong buy, Berkshire Hathaway’s stock is seen as undervalued with strong financials.

Disney

Disney is another favorite among Wall Street analysts for the remainder of 2024. Analysts predict that Disney’s shares could rally by nearly 25% in the next 12 months. The demand for Disney’s parks segment remains strong, and around three-quarters of analysts have a buy or strong buy rating on the stock. Disney shares have already gained 12% in 2024, indicating a positive trend.

Despite the underperformance of the energy sector compared to the broader market, some energy stocks are expected to shine in the second half of 2024. Stocks like Coterra Energy, which is up less than 5% year to date, have a potential upside of 26.5% based on analyst forecasts. Analysts believe that Coterra Energy has favorable prospects, with two-thirds of them rating it as a buy or strong buy.

Chevron

Chevron, the oil giant, is another energy stock that is expected to outperform in the coming months. Trading at a forward P/E ratio below its 5-year average, Chevron shows potential for growth. The company’s strategic moves, like the acquisition of Hess for $53 billion and the ongoing competition with Exxon Mobil over offshore oil assets in Guyana, indicate positive momentum. Despite only a 2.8% gain year to date, Chevron’s stock is poised for further growth.

The second half of 2024 presents opportunities for investors to capitalize on stocks that are forecasted to outperform. With the market rallying and positive sentiments from analysts, investors can consider allocating their portfolios towards stocks like Berkshire Hathaway, Disney, and energy companies like Coterra Energy and Chevron for potential gains in the months ahead.

Leave a Reply