Recent polling data shared with Sky News indicates that there is a widespread belief among the public that the Conservative party is more likely to raise taxes than the Labour party. The research conducted by Savanta revealed that a significant portion of the respondents expressed skepticism towards promises made by both parties regarding tax policies. Specifically, when asked about pledges not to increase major taxes such as income tax, national insurance, and VAT, 41% of respondents stated that they did not believe either party.

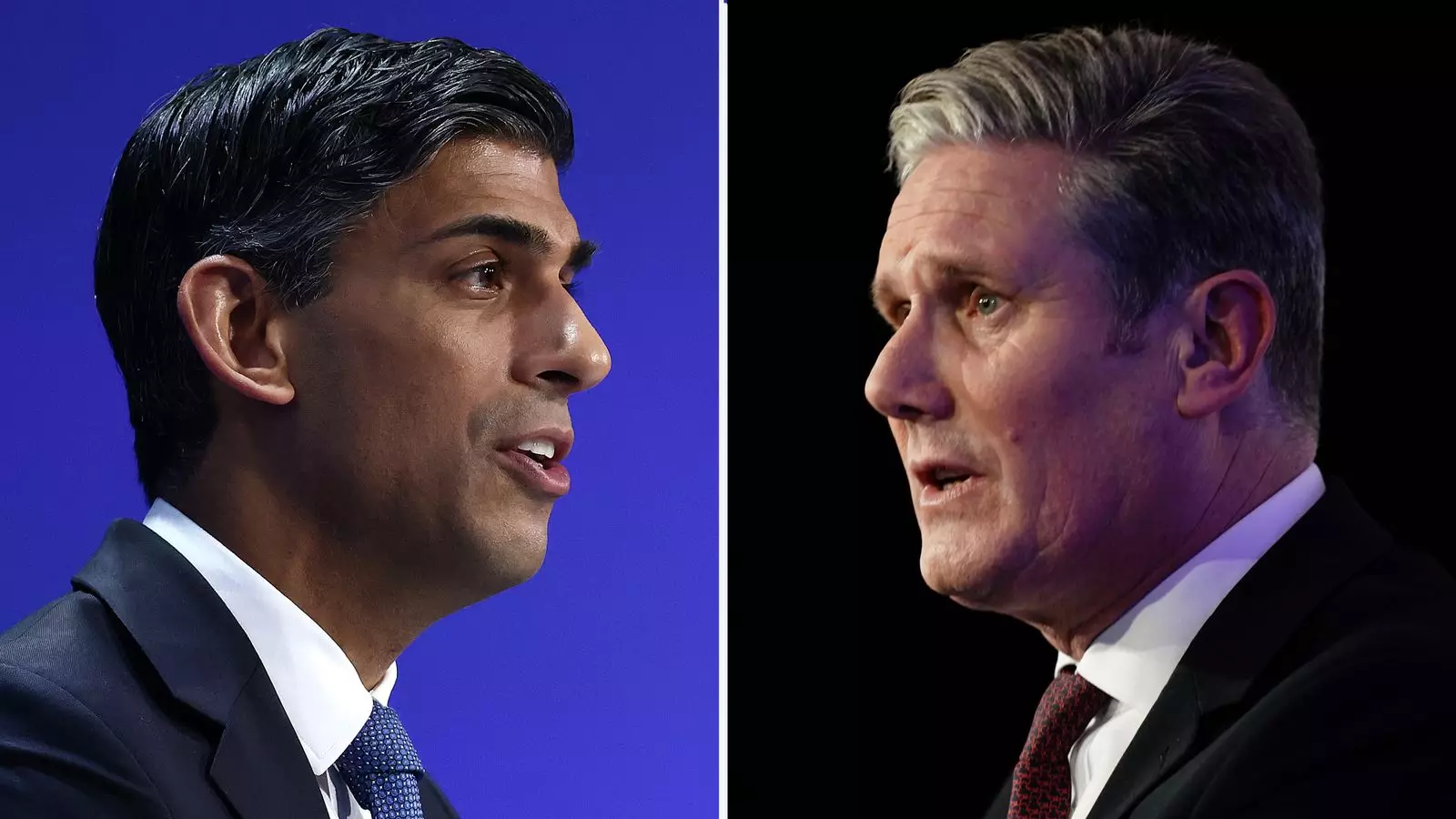

The online survey, which involved 2,217 UK adults aged 18 and above, further highlighted that only one in six individuals believes that Rishi Sunak, the Chancellor of the Exchequer, will not raise major taxes. In comparison, one in four respondents expressed trust in Sir Keir Starmer, the leader of the Labour party, when it comes to tax policies. This discrepancy in public perception underscores the importance of credibility and trust in political leaders, especially in the context of economic policies and taxation.

Debate Over Taxation

The issue of taxation took center stage during the first televised debate between Mr. Sunak and Sir Keir. Mr. Sunak repeatedly emphasized that Labour’s proposals were not adequately costed and would necessitate significant tax increases for households. In response, Sir Keir dismissed these claims as “absolute garbage” and contested the figures presented by the Conservative party. The debate highlighted the differing approaches of the two major parties towards taxation and fiscal responsibility, with Mr. Sunak attempting to portray Labour as fiscally irresponsible and lacking transparency in their economic plans.

The debate surrounding taxation and government spending has also raised questions about transparency and accountability in the political process. The assertion by Mr. Sunak that there was a £38.5 billion funding gap that needed to be addressed over four years was challenged by Labour, who claimed that the calculations were based on assumptions from special advisers rather than an impartial assessment by the Civil Service. This discrepancy underscores the importance of clarity and accuracy in presenting economic data to the public, especially during an election campaign where policies and promises are scrutinized by voters.

Impact on Voter Perception

The Savanta poll revealed that individuals aged over 55 were particularly skeptical of both major parties’ promises regarding tax policies. This demographic group, which is considered crucial for the Conservative party, expressed a lack of belief in the pledges made by political leaders. This indicates a potential challenge for the Conservative party in winning over older voters who are wary of tax increases and are seeking reassurance regarding economic stability and financial security.

The public perception of tax policies and party credibility plays a significant role in shaping voter attitudes and preferences during an election. The ongoing debate over taxation and fiscal responsibility underscores the need for transparency, accountability, and clarity in presenting economic proposals to the electorate. As the UK heads towards a crucial election, the issue of taxation is likely to remain a key point of contention between the major parties, highlighting the importance of effective communication and trust-building strategies in engaging with voters on economic matters.

Leave a Reply