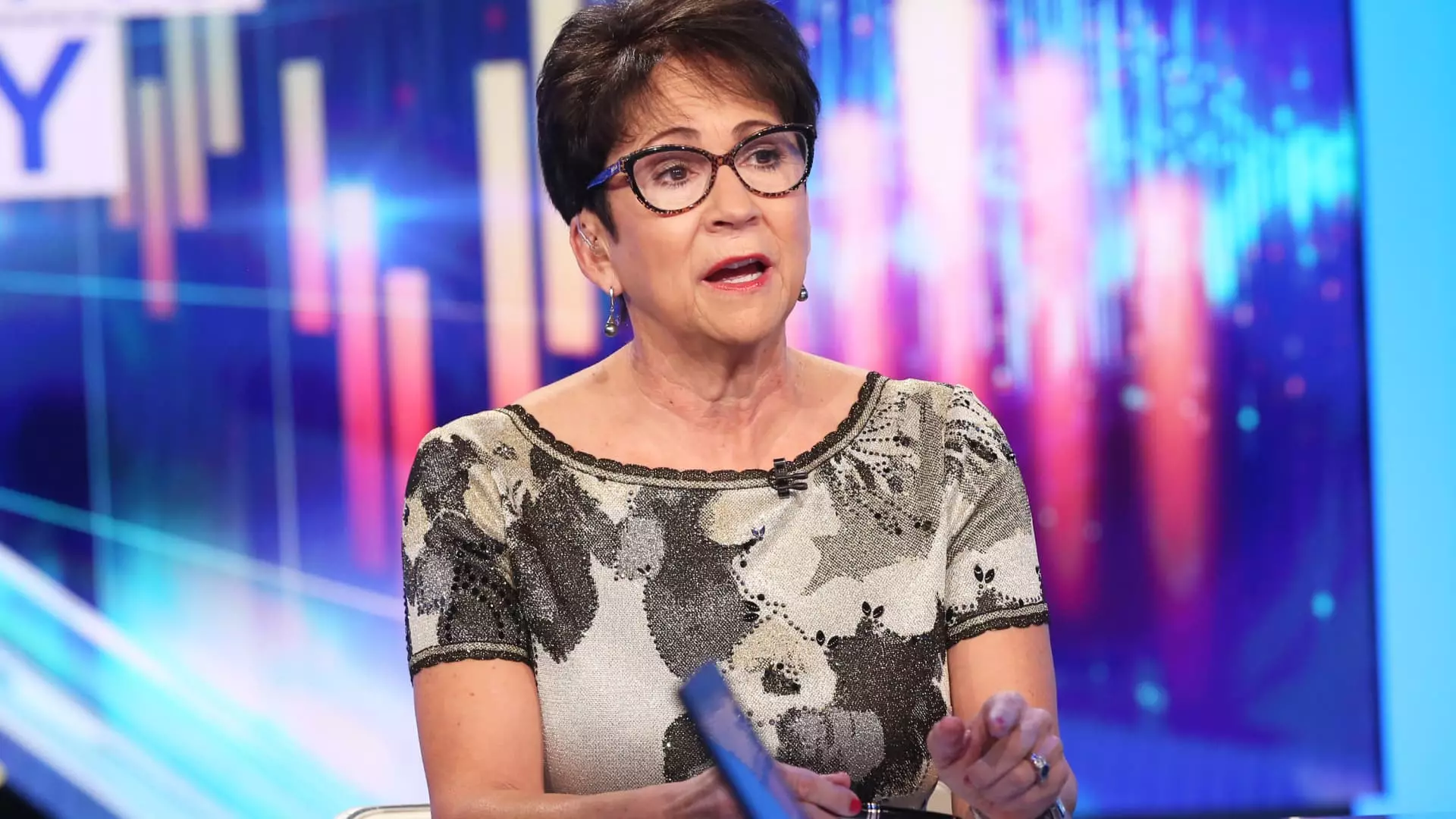

Artificial intelligence has long been associated with technology companies, but its benefits extend far beyond this sector. According to Nancy Tengler, the CEO and CIO of Laffer Tengler Investments, there are numerous opportunities in other industries to leverage AI for growth and profitability. While tech giants like Nvidia and Meta Platforms have seen significant gains from AI advancements, Tengler emphasizes the potential of old economy companies embracing the digital transformation fueled by AI.

Tengler highlights industrial and consumer discretionary stocks that have embraced robotics and AI to enhance productivity and profit margins. She refers to companies like Emerson Electric, L3Harris Technologies, Visa, Walmart, and McDonald’s as the “picks and shovels” of AI, poised for continued growth and stock performance. This shift towards generative AI presents a compelling narrative for boosting productivity and fueling growth across various sectors.

Emerson Electric and L3Harris are cited as examples of industrial firms at the forefront of automation through digitization. Tengler’s firm has recently increased its positions in both companies, underscoring their commitment to AI adoption. Emerson Electric, known for manufacturing fluid controls and industrial valves, has outperformed the S&P 500, drawing attention from analysts who project significant growth potential.

L3Harris, an aerospace and defense company based in Melbourne, Florida, has leveraged AI and machine learning for years, aligning its future projects with the Defense Department’s AI initiatives. JPMorgan analyst Seth Seifman upgraded L3Harris based on its valuation and strategic focus on shareholder value, predicting a positive outlook for the company. With analysts backing the company and projecting substantial growth, L3Harris is positioned for further success in the AI landscape.

Walmart, one of Tengler’s top choices for AI investments in the “old economy,” has witnessed a significant increase in stock value and dividends. Tengler points to Walmart’s advancements in e-commerce, automation, and generative AI as key drivers of growth and efficiency. By adopting robotics and AI solutions, Walmart has streamlined operations, enhanced productivity, and achieved substantial growth in its online and advertising businesses.

In addition to traditional tech stocks, Tengler’s investment strategy emphasizes companies offering growth potential at a reasonable price. This approach includes mainstream AI plays like Broadcom, Amazon, and Microsoft, expanding the scope of AI investments beyond conventional tech companies. By diversifying the portfolio with AI-influenced stocks from various industries, investors can capitalize on the transformative power of artificial intelligence across the market.

Leave a Reply