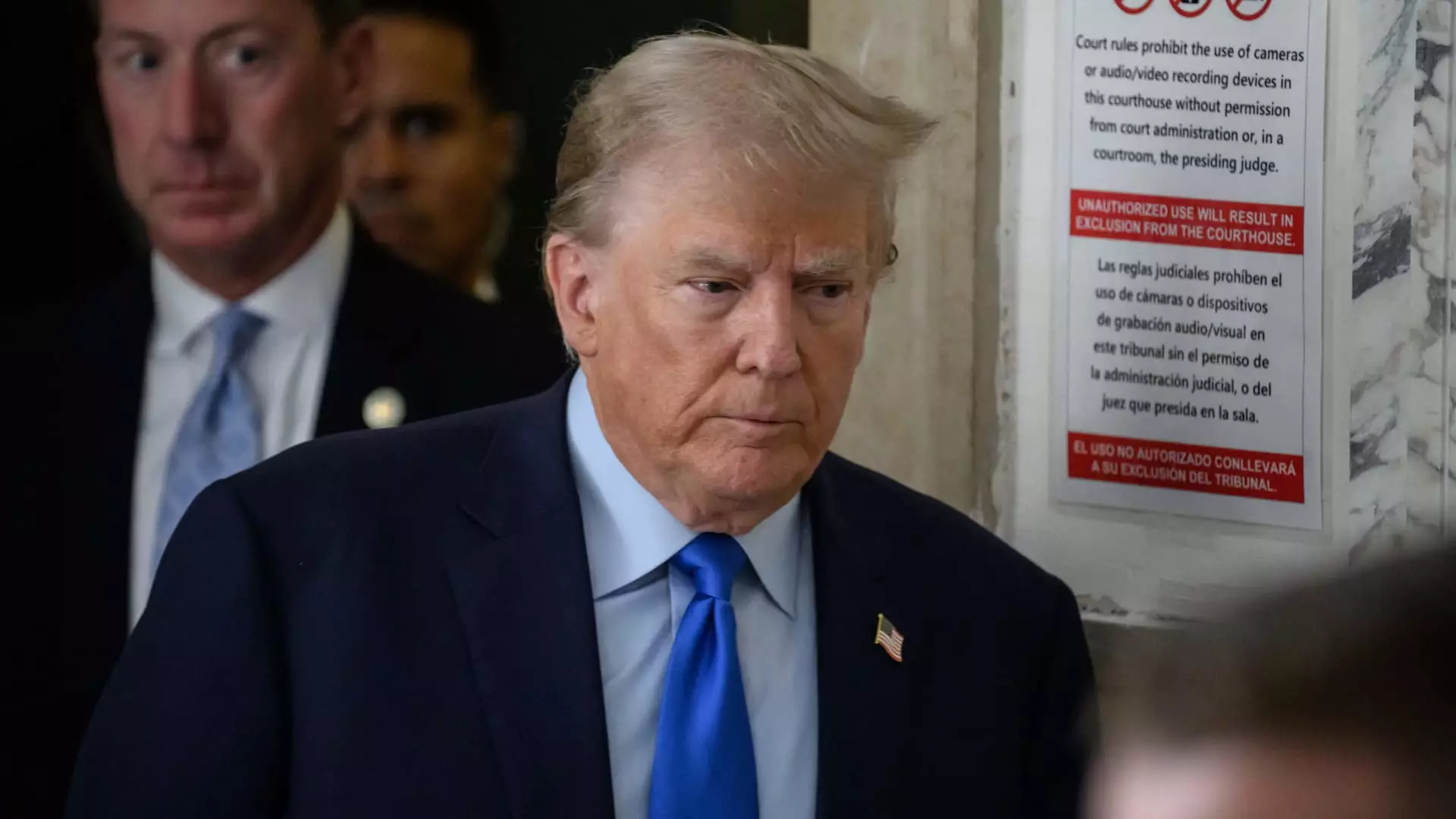

In a recent court filing, attorneys representing Donald Trump and his co-defendants announced their plan to post a $100 million bond to temporarily halt the enforcement of the civil fraud judgment against them. This move comes after the defendants were ordered to pay a total of $464.6 million in fines and interest by Judge Arthur Engoron. However, this $100 million bond is only a fraction of the staggering amount that they have been mandated to pay.

The defense team argued that it would be “impossible” for them to secure a complete appeal bond, which could potentially exceed $550 million. New York Attorney General Letitia James, who initiated the fraud case, swiftly opposed Trump’s request for a stay on the judgment. James emphasized that there is no justification for allowing the defendants to post a partial bond, considering their apparent lack of liquid assets to cover the full judgment amount.

The Financial Strain on Trump

The court’s ruling not only imposed substantial financial penalties on Trump and his associates but also restricted his business activities in New York for a period of three years. Additionally, Trump was barred from seeking loans from state-registered financial institutions during this timeframe. The mounting interest on the judgment, accruing at a rate of 9% annually, further compounds Trump’s financial burden, adding close to $112,000 to his debt every day.

Trump’s legal team highlighted the standard practice of surety bond agencies to set the bond amount at 120% of the judgment to cover interest and appeal expenses. Given the exorbitant nature of the judgment and the accompanying business restrictions, the defense lawyers argued that it would be exceedingly difficult to obtain and post a bond exceeding $550 million. Despite this challenge, the defendants expressed their intent to proceed with a $100 million bond as a means of securing a temporary reprieve from the judgment.

Monitoring Trump’s Real Estate Assets

One notable aspect of the legal battle is the court-appointed oversight of Trump’s extensive real estate holdings in New York. A financial monitor has been tasked with ensuring that there is no unauthorized transfer or dissipation of assets. Trump’s attorneys asserted that this oversight arrangement, coupled with the proposed bond amount, would provide sufficient security to satisfy any affirmed judgment. They framed the bond as an additional layer of protection to reassure the court and the Attorney General’s office.

The ongoing legal saga involving Donald Trump underscores the complexities and financial challenges associated with high-stakes civil fraud cases. The proposal to post a $100 million bond represents a strategic move by the defendants to delay the enforcement of the judgment while navigating the intricacies of the appeals process. As the legal battle continues to unfold, the ultimate resolution remains uncertain, with significant implications for both Trump and his co-defendants.

Leave a Reply